Introduction

Do you like rollercoaster rides? If yes, you are probably enjoying the current market environment... In the last two weeks, a day of euphoria has usually been followed by a day of fear – and it’s likely going to continue like this for the time being with macro consolidation being the likeliest scenario.

With lingering uncertainty in stock markets and US indices likely testing critical support levels soon, it’s no wonder that crypto isn’t able to fly currently. On the bright side, the crypto markets have shown more relative strength compared to the stock markets.

However, there is no way around the fact that crypto – with the number of institutional investors in the space now – has become increasingly correlated with other risk assets. Thus, understanding the moves of the stock markets is key to predicting where crypto could be headed next.

Market Outlook

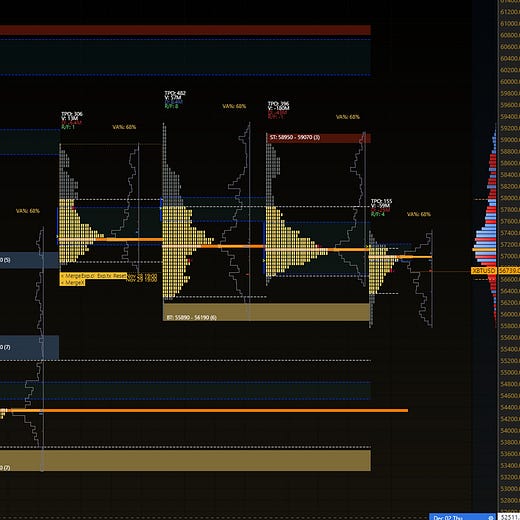

With Bitcoin still in a mid-term downtrend, the burden of proof currently lies on BTC bulls. Until BTC is able to breach the critical resistance levels at approximately $61k, we have to remain cautious for the time being.

One thing is clear: There is a lot at stake in the crypto markets right now and the price moves in the weeks to come could be rather dramatic – especially with the historically high levels of leverage across the board.

A notable exception in today’s mostly red crypto market has been LUNA which, after a period of consolidation, is catching up to its continuously improving fundamentals (aka, LUNA burns due to increased UST demand).

The Long-Term Prospects for Crypto Look Bright

Despite the short- to mid-term macro uncertainty and headwinds for the crypto markets, the long-term outlook couldn’t be brighter (for the space overall, not necessarily each and every altcoin, of course…) The amount of capital – both intellectual and monetary – that has been pouring into the crypto industry is simply stunning.

With tech giants such as Facebook (or Meta…) increasingly opening up to the crypto industry, the path to mainstream adoption is paved.

When it comes to timeframes, however, we have to be realistic: Despite the massive improvements and innovations we have seen in the crypto space this year alone (just think DeFi and NFTs), we are far from reaching a state where crypto as a technology is suitable for the average joe. It will take years and the rollout of new killer applications (will it be blockchain gaming?) in order to reach a tipping point.

The Next Airdrop for Early DeFi Adopters

If you have been reading this newsletter for a while and followed our call to try out the Lyra protocol on Optimism, then you’re lucky: As predicted, Lyra is rewarding early users and protocol testers with a retrospective airdrop!

Fresh Yield Farming Pastures

In times of market uncertainty – and in general, for more risk-averse crypto investors – stablecoin yield-farming is an attractive endeavor. While there are barely any triple-digit yield opportunities anymore like we saw in the early DeFi days, double-digit yields are not to be despised…

Today, we have gotten two new yield farming opportunities, one on Avalanche and one on Polygon – so, no expensive gas fees for both of them... The yields on stablecoins are currently around 30 - 40 % but will likely come down a bit in the days to come.

A Reminder of the Risks in DeFi

With DeFi protocols having become the go-to financial applications for many crypto users, it is easy to forget that the risks in this nascent ecosystem are still fairly high. Even reputable and time-tested protocols can fall victim to hacks and sophisticated exploits. So, be careful when playing around, especially with new DeF protocols, and spread your bets to not risk all your money in one place.

Thank you Oliver !

Hey Oliver, I love Vietnamese coffee because with a small burst of condensed coffee and milk I get all the flavor I need. I get this same feeling with your updates. For four years now the crypto world has swung my emotions like no other. What I learned from not capitalizing on previous crashes is that this is not an investment for the weak. Crypto makes the risks that come with entrepreneurship feel like a walk in the park. It requires the ability to think through angles, intellect to dissect the noise, and the conviction to stick with the things you believe in. Happy to be a builder in this space