Introduction

We have talked a lot about markets and macro topics lately – but mostly on a relatively short-term basis. In today’s video, we’ll take a closer look at how the economy is changing in front of our eyes, how we should position and why soon, the last good investing opportunities of our lifetimes might arise… Strap in!

Falling From a Sugar High

The last few years have undoubtedly been crazy – with more than just one “black swan event”. The Covid crisis led to an almost complete standstill of the global economy. Instead of letting the economy and markets run their natural cyclical course, governments and central banks decided to “paper over” the cracks with unprecented amounts of money – not without consequences: First monetary (aka asset) and now “real” inflation have led to massive dislocations across the economy and asset markets.

Now, in 2022 we witness the dreadful consequences of these unsustainable actions: Inflation is rampant, and the Fed’s reactionary force has led asset markets crashing – effectively squeezing both the lower and upper end of society.

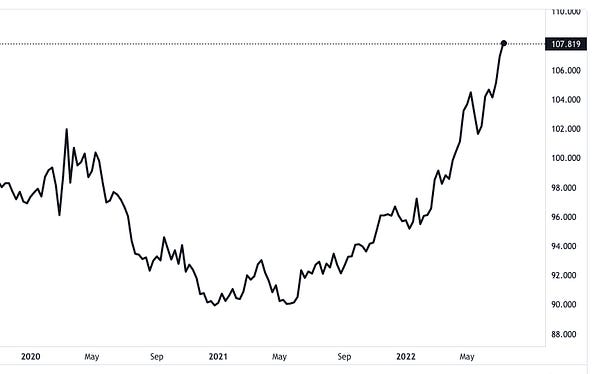

The only winning strategy of 2022 so far? Not fighting the Fed. While this meant holding assets in times of monetary easing, it’s the opposite during tightening periods: Holding US dollars, a strategy which mostly hasn’t worked out in past decades – and likely won’t in the long-term – has been the “trade of the year” so far.

On the bright side, this “dollar squeeze” will lead to tremendous buying opportunities – maybe the last for a long time! Once the massive dollar uptrend reverses, we can expect asset prices to rise A LOT. In this article, we’ll lay out why now is the time to pay attention because soon, the time to make generational wealth might be running out…

Recessions Are Common Events – Is This One Different?

While the theme of 2021 was the recovery from the pandemic, in 2022, the global economy has been facing major headwinds: From the global inflation and energy crisis to deepening geopolitical tensions and the implosion of the Chinese economy and real estate market, there is no shortage of issues. While the data will tell if we are already in a recession or will face one next year, fact is, that a global recession seems almost inevitable at this point.

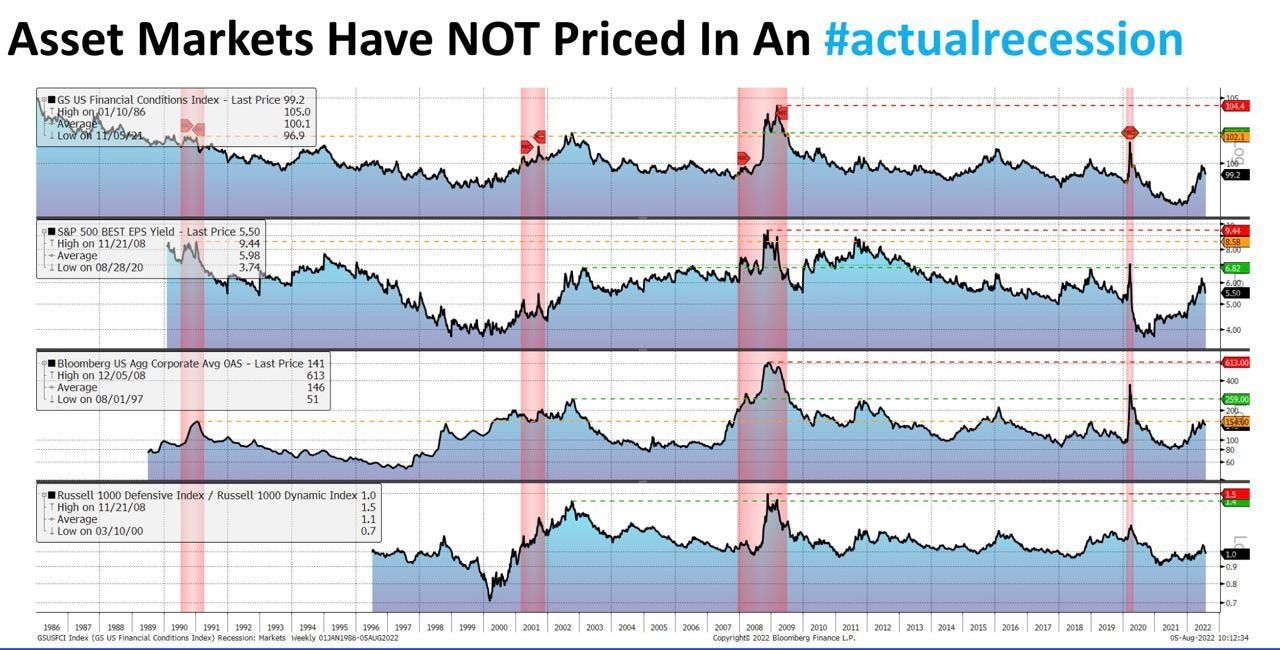

So, knowing that some serious economic pain probably still lies ahead, how can we prepare and set ourselves up for growth during these unpleasant times? First of all, it’s important to know that recessions are not rare events. In fact, they have happened on a regular basis throughout history and are a normal part of economic and financial growth. You can see in the graphic below that recessions pretty much always align with stock market crashes.

Consequentially, recessions are ripe with opportunity. In the graphic below, you can see how stocks performed during, before, and after a recession. In almost all cases, buying during a recession leads to outsized returns! The larger the recession, the greater the returns, but also the riskier and harder it is to time.

What is the conclusion here? Big buying opportunities are likely still awaiting us, and we want to be ready to take advantage of them. How can we do that? First of all, by not gambling away our money during this bear market – capital preservation is key. Secondly, it’s important to have enough dry powder and free cash low (aka an income) to be ready to deploy in the markets when the time is up… Patience and emotionless execution will set apart winners from losers in this unprecedented crisis.

The Last Chance for Generational Wealth Could Be Upon Us

Now that we have shown that recessions are frequent and generally serve as great buying opportunities let's address why this upcoming recession could be different (dangerous words I know) and be the last chance to make generational wealth for a long time.

First of all, we have to look at a few charts. Everything starts in the year 1971 when Richard Nixon removed the US Dollar from the gold standard. As you can see, we have had unprecedented monetary and consumer price inflation ever since.

The value of assets has skyrocketed in comparison to incomes, making real estate and most assets almost unattainable for the average person.

Debt as a percentage of GDP has skyrocketed, making living off debt the new standard and increasing even larger difficulties for the average joe to attain assets.

Looking at these charts, it becomes clear: Acquiring and holding assets has been the ONLY viable way to protect oneself from inflation and create generational wealth. While it would have been enough just to enter the market at some point in the past decades and hold for a long enough period, riding (and exiting) asset bubbles like the dotcom or crypto manias has been a fast way to outsized returns.

In order to understand why soon may be the last good time to acquire assets at fair valuations, we have to look at the longer-term macro outlook:

Currently, central banks are on a mission to fight inflation and strengthen their fiat currencies – a mid-term trend that has put risk assets under tremendous pressure year-to-date. This leads to the effect of money flowing out of assets and into strong currencies like the US Dollar.

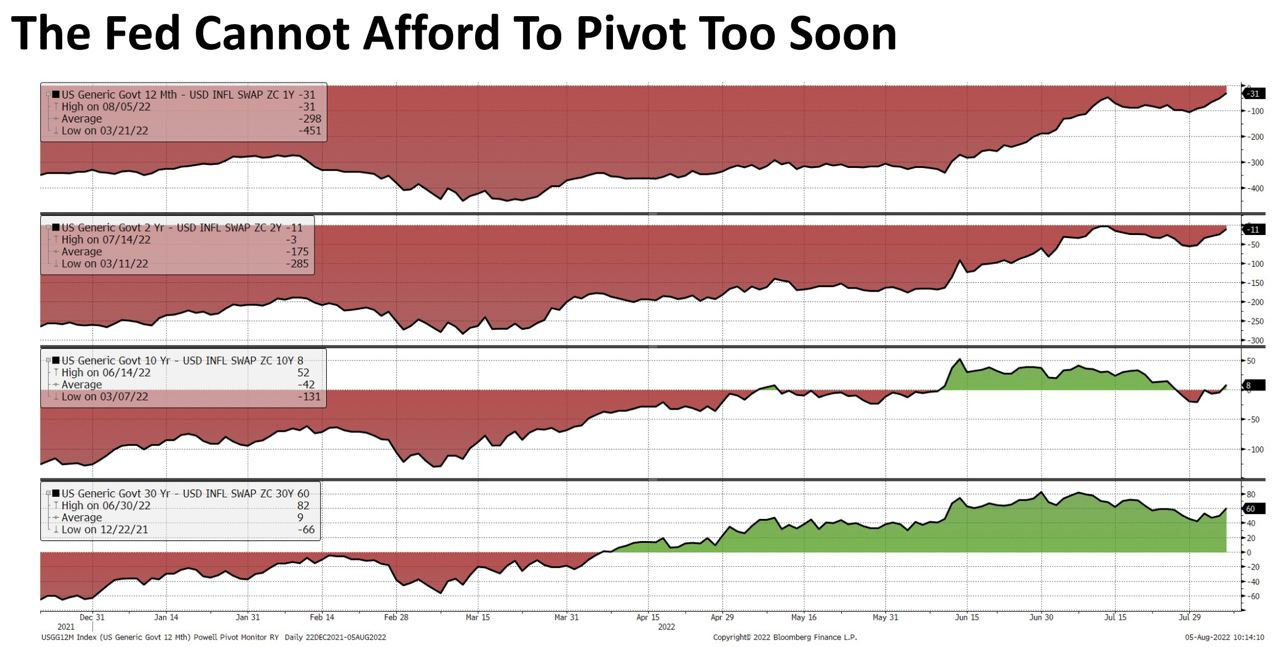

Looking at historical charts, however, we know that such episodes of monetary tightening have been RARE and SHORT in the past decades. Looking at the record-high debt levels of both states and consumers, we know that this monetary tightening cannot go on forever. In fact, our whole economic model is based on creating more debt and stimulating growth by injecting more money into the system. Contracting economies are a NO-GO in the Western world because prosperity and societal peace depend on growth. The question is just: When will they start printing again?

In order to achieve the desired effect, central banks had to inject a significantly larger quantity of money into the system after every crisis. At some point, this fiat-based monetary system will likely become to iondebted and reach a breaking point. We have already seen cracks in recent months: Many countries have started to move away from the US Dollar and into hard assets such as gold and commodities – China being a leader at this front. This trend will only accelerate in the years to come.

Also, in order to prevent the debt-based system from blowing up, it’s probable that the US will at some point have to resort to yield curve control – a mechanism that artificially prevents yields from rising and thus alleviates the debt burden on the economy. There is one sacrificial lamb with YCC, however: the currency. Just look at how the Japanese Yen has crashed year-to-date because the Bank of Japan artificially suppressed its bond yields. The US Dollar could face the same fate at some point against hard assets…

Now comes the timing aspect: Once the next Fed pivot actually becomes reality, things could shift extremely FAST! People will pile into assets and out of fiat currencies at a record pace. Already today, we see rampant FOMO when central banks even signal the slightest possibility of reversing to easing at some point ... The markets have been conditioned to “buying the dip” and trying to front-run any potential pivot. The fact that this market anticipation could be premature and a fakeout makes this game so hard!

However, history has shown that markets rarely bottom before an ACTUAL pivot by central banks and/or bottoming of the economy. Without monetary stimulus or economic growth, the natural direction for asset prices is down… Thus, we might still see the biggest buying opportunities still lying ahead of us.

Once a “Fed pivot” actually happens, the trust in fiat currencies could continue to erode rapidly (as it has in the past decades) due to the fact that everyone knows that buying assets has been the only viable strategy. This could lead to prices of hard assets rising quickly, leaving cashholders on the sidelines. The big task will be to anticipate this shift! Therefore: All eyes on inflation and growth data in the coming months and how Fed speakers react to it in order to get a signal for our next big play!

Why should you be concerned that soon the time for generational investing gains could be over? Because the elite of this world doesn’t want you to be free and rich! As the WEF stated as part of their “Great Reset” agenda: “You will own nothing and you will be happy.” This threat of reduced property rights and redistribution of wealth will hurt the everyday person’s ability to “make it”. Therefore, we have to make our next big plays before it’s too late…

There is one more reason why this recession might offer the last good opportunity to buy crypto: Crypto has gone through several cycles and “mini-bubbles.” As with every nascent technology and asset class, this is completely normal, but with time, as the space matures, the principle of diminishing return sets in. While it might signal good things when it comes to adoption, as an investor, the biggest opportunity lies in the early stages of an asset class. Thus, the next cycle could be one of the last ones to really offer significant gains to investors.

And some people say diminishing returns for $BTC is not a thing. Here is market cycle ROI on a linear scale. Don't argue with me, argue with the data.

Been patient, not deploying, respecting the Macro narrative while waiting on the opportunity to buy lower with my limited resources, but have to keep fighting the fear that the bottom was already in and I’ll be left behind. If everyone is calling for lower, doesn’t conventional wisdom say the opposite will happen?

Yo Oliver, thanks for the recent posts man 🤞