Introduction

DeFi stands for Decentralized Finance. There are a ton of different components that make up this industry, and the list is growing every day. The landscape is competitive, and there are a number of DeFi solutions built on top of the different Layer 1 protocols (Ethereum, Avalanche, Terra, Fantom, Solana, etc.). Some people make the mistake of becoming tribal and believing that one protocol will control the entire sector. However, it is my conjecture that there will be more than enough room for multiple protocols and projects to grow and thrive.

DeFi is truly the future of finance. However, due to the continued explosion of the industry throughout the past year, there are a lot of new retail investors that are still attempting to find their way in this sector. The purpose of today’s post is to provide some clarity around the world of DeFi. Either way, you need to be familiar with this space because this will ultimately shape your financial future. So, be sure to equip your oxygen tanks and double check your scuba gear as we dive deep into some DeFi terminology.

Disclaimer Time! Any projects that are listed below ARE NOT to be taken as a buy signal. I repeat, ANY PROJECTS LISTED BELOW ARE NOT TO BE TAKEN AS A BUY SIGNAL!!! I realize that a good majority of the population are visual learners. So, the projects that are listed are there for the purpose of serving as hands-on examples used for learning purposes ONLY….nothing more, nothing less.

Let's Talk About CEXes

CEX is the acronym for Centralized Exchange. If you're familiar with regular stock exchanges, a centralized exchange is basically the same thing......except instead of stocks, you purchase cryptocurrencies.

This is where most newbies will make their first crypto purchase. The drawbacks of using CEXes are that they could be subject to regulation, manipulation, or hacks. In fact, exchange breaches are a regular occurrence in crypto. This is why you should never leave your coins or funds on a CEX.

Examples of popular CEXes are:

Now, Let's Talk About DEXes

If CEX is the acronym for Centralized Exchange, can you guess what DEX is the acronym for? If you guessed Decentralized Exchange, then congrats. A DEX is a digital cryptocurrency exchange where users buy and sell directly to each other (Peer to Peer aka P2P).

This is achieved through smart contracts where the DEX acts as the protocol that connects the users. Liquidity is provided by users through a process where they stake their coins to a liquidity pool (we'll cover this in a second).

DEXes are revolutionary because they are unregulated and immutable... meaning that they cannot be shut down (if built in a truly decentralized way).

The Robinhood debacle with $GME and $AMC should prove the value of decentralized exchanges. However, there is a caveat to using a DEX. Due to the decentralized and unregulated nature of these exchanges, there is a greater chance for rug pulls and other fraud schemes. So, you must exercise caution when using these.

Examples of popular DEXs are:

Gas Fees

Ethereum smart contract transactions are validated using proof of work. Miners use mining rigs to verify every transaction on the blockchain. The ASIC (Application Specific Integrated Circuits) mining rig solves complicated numerical equations, and in return the miners receive rewards.

These rewards are known as gas fees. Gas fee prices vary depending on the network activity at the time of use. This means that if the network is highly active, then gas fees can get pretty expensive.

Users have the ability to increase the amount of gas fees they are willing to pay for a faster transaction time. This also leads to increased prices.

High gas fees have been a big issue during this year's bull run (probably the biggest). Although there have been some breakthroughs with other Layer 1 and Layer 2 protocols.

Slippage

Slippage occurs in a trade when there is a difference between the expected price of the trade, and the price the trade is actually executed at.

A lot of times, there will be a difference in price due to short-term volatility and liquidity. There can be slippage anywhere between practically 0 and 10+% (if liquidity is low). By setting slippage limits users can protect themselves from unfavourable outcomes.

It's important to always check (for example on Coingecko) on which exchange or blockchain there is the best liquidity for a token.

Liquidity Pools

Liquidity pools are what provide the DEXes with the necessary liquidity to complete a trade. This is the bread and butter of every exchange. Users create liquidity pools when they stake their tokens to the pool for fees and rewards in return.

These rewards can come in the form of additional tokens, airdrops, voting rights, etc.

Yield Farming

When your tokens are staked or lended out in return for rewards, this is known as yield farming. Think of it as depositing your money into an interest accruing bank account. The bank lends your money to other borrowers, and in return you receive a percentage of the interest payments received from the loans (a very small percentage, but a percentage nonetheless).

Yield farming in DeFi is a great source of passive income, because the APY that you receive is much higher than traditional finance could ever provide (up to 20%, and much higher in certain cases).

Also, farmers receive additional token rewards on occasion. Here is a great thread on the benefits of yield farming

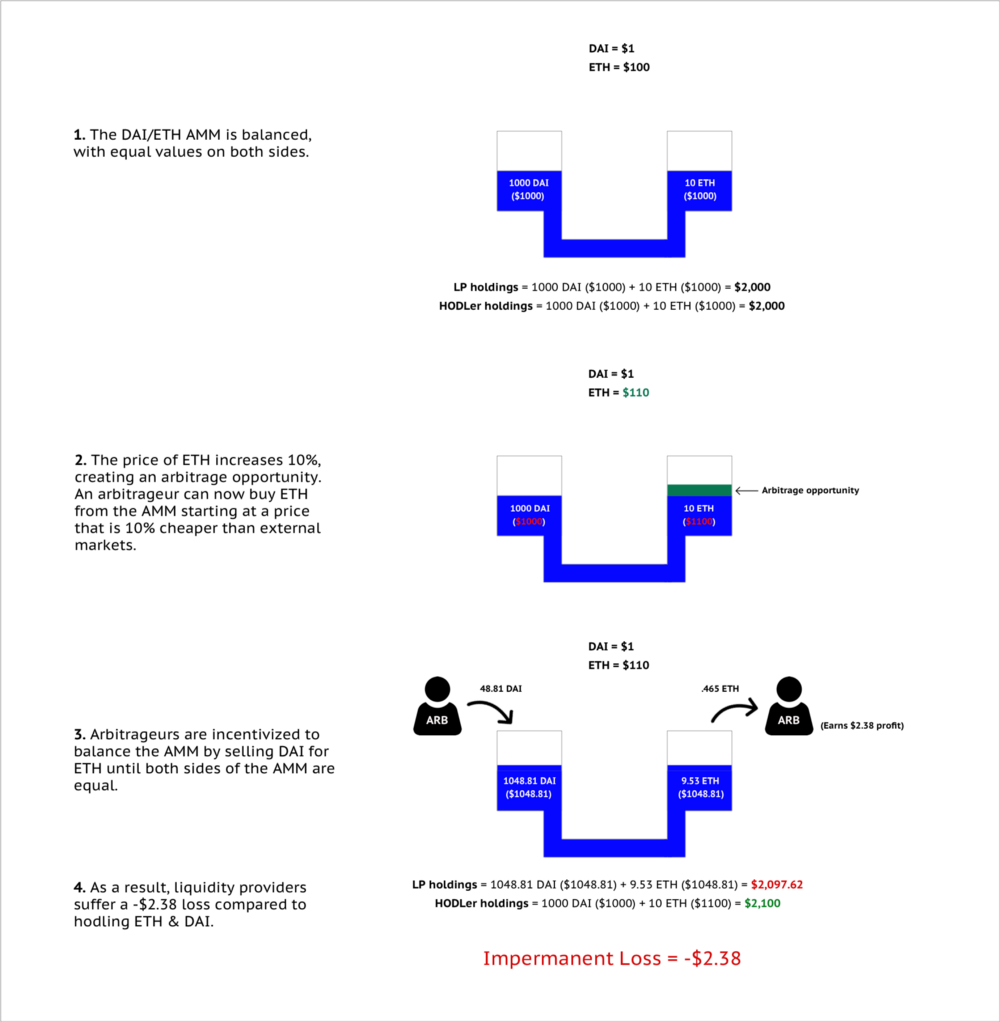

Impermanent Loss

When you deposit your crypto to a yield farm, you must pair that particular crypto currency with the same amount of ETH (or another base currency).

For example, if you stake $1000 worth of $MPH tokens, you must also stake $1000 worth of ETH. This is known as a trading pair. If at any time of you staking, one coin in the trading pair becomes more volatile, impermanent loss occurs. This is how it goes:

Source: Bancor The loss is not permanent until you remove your liquidity from the pool (hence the term, impermanent loss). In order for impermanent loss to be prevented, ETH would have to return to the price it was when you first added liquidity.

If you remove your coins from the liquidity pool before the price returns back to normal, it turns into a permanent loss. Sucks, I know, but that is the risk you take when you provide liquidity. However, if you join a great liquidity pool, the risk can be well worth it.

Derivatives/Options

Derivatives are any investments that are based on or derived from an underlying asset. Derivatives are used for speculation, hedging, and leveraging positions.

This is a huge opportunity for crypto, seeing as how the derivatives market is the largest financial market in the world. The derivatives market is estimated to be worth at least $1 Quadrillion on the high end (which to me, is highly problematic because there isn't that much money in the world).

As you can imagine, there are plenty of opportunities to build wealth around derivatives.

Projects that are tackling derivatives are:

Lending

In crypto, there are a few different types of creative lending strategies/instruments. You have:

Flash loans - Exclusive loans where coins/tokens are loaned out interest free as long as the loan is paid back before the transaction block is completed. This is because the loan and the repayment are bundled into the same block. The loan can be used on whatever you want, but they are mostly used for arbitrage. A transaction block can take anywhere from a few seconds to 10 mins to complete. So, only use these loans if you know exactly what you're doing.

Lending Aggregators - These are smart contracts that find the best lending rates for users lending their coins to receive a return on their investment.

What makes a crypto loan convenient, is that you're able to use your coins as collateral. This eliminates the need for unnecessary credit inquiries, unreasonable collateral requirements, etc.

Examples of lending platforms are:

Conclusion

The DeFi sector has seen its cycles of ups and downs. However, make no mistake about it, my firm belief is that DeFi will flip traditional finance on its head. The only way to take full advantage of this transition is to understand and learn more about it.

Helping you all navigate this space is my sole purpose for writing this post. So, if there's anything else that you all would like for me to expound on surrounding DeFi, feel free to drop a comment below!

Great post thank you so much, we are doing great, keep it up team, we are all looking at you!

Thank you for the lovely articles, have been learning so much from you :D