These Are Projects In Fantom’s Ecosystem Worth Watching

Projects To Keep An Eye On During Fantom Season

Introduction

It’s looking like we’re starting the new year off with new life being breathed into some of the L1 protocols that have been flying under the radar for the last few months. One of the L1s that is being shown some love is Fantom. Back in November, I covered Fantom in depth (feel free to read the article here). Today, I’d like to cover some of the projects that are native to Fantom’s ecosystem.

Please keep in mind that this is not a call to action for anyone to invest in any of the projects discussed today. It is my goal to make you all aware of what’s out there. If anything discussed today peaks your interesting, always be sure to follow up with more research before making any financial decisions.

Tomb Finance

The first project we’ll talk about is Tomb Finance. Tomb is probably the most popular project in the Fantom ecosystem.

Tomb Finance is a DeFi protocol that aims to help Fantom solve its future liquidity issues by providing a medium of exchange – TOMB – that is pegged to FTM (more on that later).

The protocol has three tokens:

TOMB - Tomb is a toke that is designed to maintain a peg to 1 FTM. Because the peg to FTM is maintained through an algorithm, it is not guaranteed that TOMB will always be valued at 1 FTM. This is because the token is uncollateralized.

TSHARE - Tomb Shares are used to gauge shareholder trust in TOMB to maintain the $FTM peg, and measure the value of the Tomb Protocol. As the epoch (measure of time) expands, the protocol mints and distributes TOMB to all holders that have staked their TSHARE tokens in the masonry. TSHARE also gives holders voting rights towards future use cases and protocol improvements. Here are some details on how TSHARE tokens are distributed.

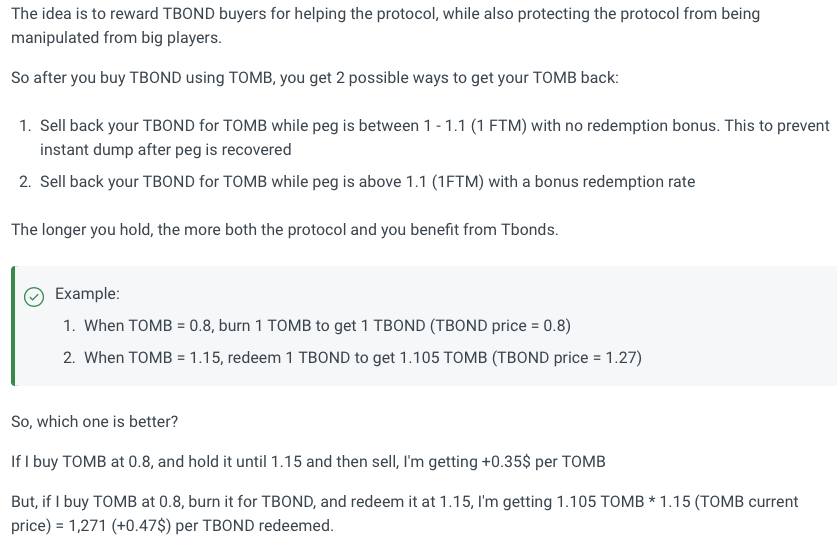

Source: Tomb TBOND - Tomb Bonds are used to help insure the TOMB peg to FTM during an epoch concentration period. TBOND tokens are issued if the price of $TOMB falls below 1 FTM. TOMB holders can buy TBOND tokens at the TOMB token’s current price. To bring the price level of $TOMB back to 1 FTM, TOMB tokens are burned when they are exchanged for TBOND tokens. Holders can redeem TBOND for TOMB tokens whenever the TOMB peg is back above 1 FTM. This sell pressure helps push the TOMB price back to 1 FTM. As long as the Treasury maintains a positive TOMB balance, TBOND tokens can be redeemed. Also, there are no expiration dates for TBOND tokens.

Tomb Finance is working towards making TOMB the main medium of exchange used on Fantom Opera. In order to achieve this, the team plans to continue to develop functionality and use cases for TOMB.

Not only will this help solidify the TOMB token as the medium of exchange, it will also help maintain the peg to FTM.

Let’s talk about the TOMB Finance platform. The site has five different categories that are used for different purposes: Cemetery, Masonry, PIT, SBS, and Liquidity.

Cemetery allows TOMB holders to earn TSHARE by staking TOMB - FTM (106.56% APR) or more TSHARE (212.38% APR).

Masonry allows users to stake TSHARE for TOMB (1019.65% APR).

PIT allows users to purchase or redeem TBONDs

SBS allows users to swap TBOND to TSHARE.

Liquidity makes it possible for users to generate LP tokens with TOMB and FTM.

Tomb Finance released a Cemetery Cycle video to teach users how to cycle their TOMB rewards

Route 2 Fi also shared a staking strategy for those who may be new to the platform.

As you can see, Tomb Finance is a complex DeFi hub with many moving pieces. It’s a thoughtful product that has the potential to be one of the greats contingent that Fantom’s TVL continues to grow.

SpiritSwap

That brings us to SpiritSwap. SpiritSwap is a DEX that is built on Fantom Opera. Think of it as the Uniswap of Fantom.

SpiritSwap has the same AMM capabilities as Uniswap. SpiritSwap also has a full suite of products which include:

Portfolio: Users have access to multiple features that include:

Liquidity

Users can see unstaked LP tokens.

inSPIRIT Stats

Shows rewards and the total number of SPIRIT a holder has locked as inSPIRIT.

winSPIRIT Rewards

Shows wrapped inSPIRIT tokens: ginSPIRIT (Grim Finance) and linSPIRIT (Liquid Driver)

Farming Rewards

Rewards and SPIRIT tokens from farming can be claimed here.

Wallet Breakdown

All assets can be viewed in the portfolio.

Exchange: Users have the ability to:

Swap tokens

Provide liquidity to different token pools

Use the Zap feature that allows users to stake to an LP with one token (Instead of using a token pair)

Migrate LP tokens between different pools.

Bridge: Gives users the ability to bridge cross chain Ethereum, Fantom, Polygon, Arbitrum, and Avalanche by using a bridge powered by AnySwap. New users also receive 0.4 FTM to offset any gas costs associated with the first transaction.

Farms: Users have the ability to participate in different farms and earn trading fees for the swaps within the pool. Liquidity providers participate in farms by using two tokens. The fee to trade is 0.3% and the farm participants receive 0.25%.

Boosted Farms: These are farms where users can stake their inSPIRIT to farms for a boosted APR (up to 2.5x boost).

inSPIRIT: SpiritSwap’s governance token

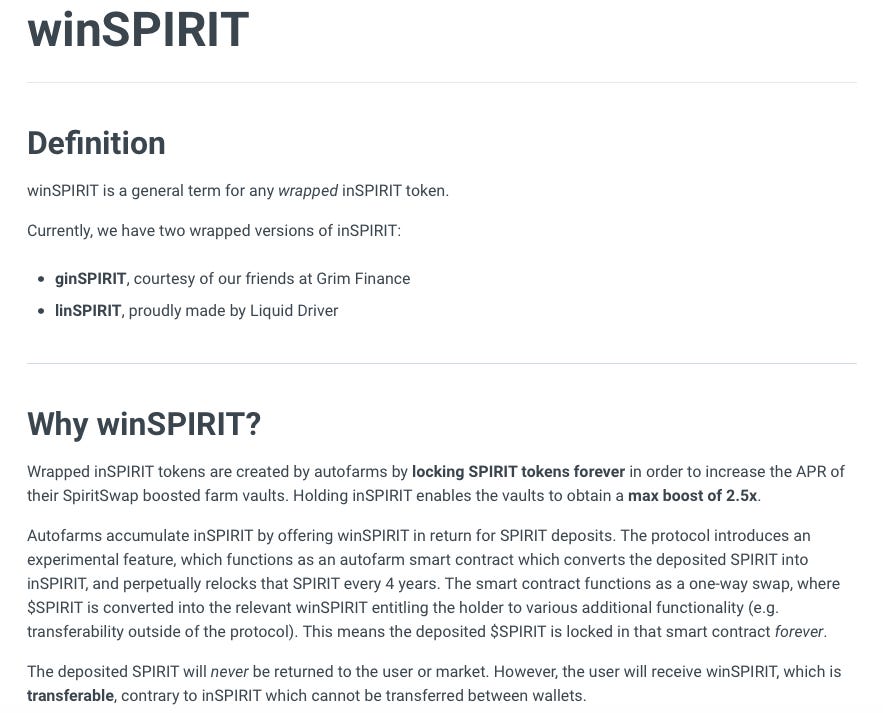

Source: SpiritSwap winSPIRIT: This is wrapped inSPIRIT.

Bonds: Users can purchase SPIRIT at a discount by depositing LP tokens. The tokens are then sent to a bond contract on Olympus Pro, where they are vested over 7days.

Lend/Borrow: Lenders can lend assets to put as collateral in exchange for an APR, and borrow against the collateral for an APR.

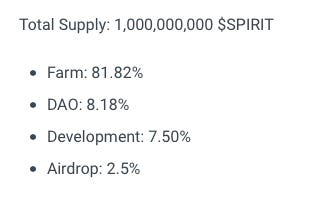

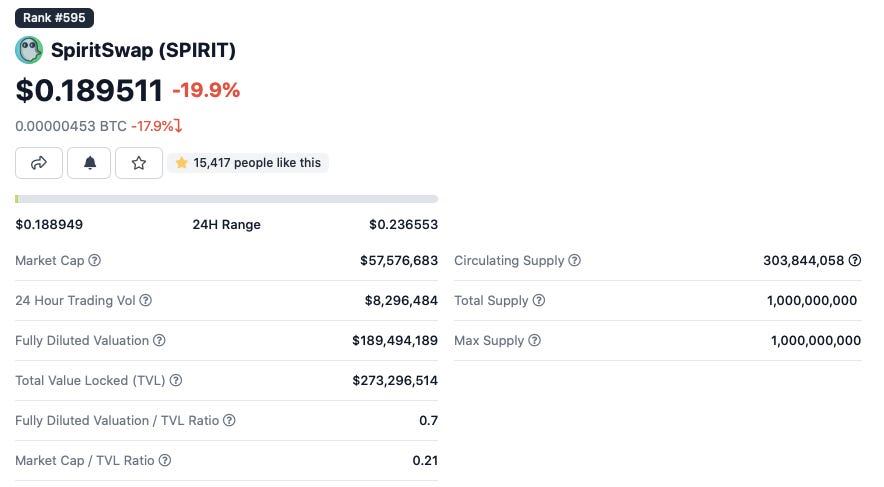

The SPIRIT token is the native SpiritSwap token that is earned by farmers on the platform. This is how tokens are distributed.

SpiritSwap is currently sitting at a market cap of $57.5M with a TVL of $273M.

Spookyswap

Spookyswap is another AMM DEX built on Fantom Opera that allows users to:

Swap

Stake Boo (Spookyswap’s native token)

Provide Liquidity

Farm

Bridge Tokens

Purchase NFTs

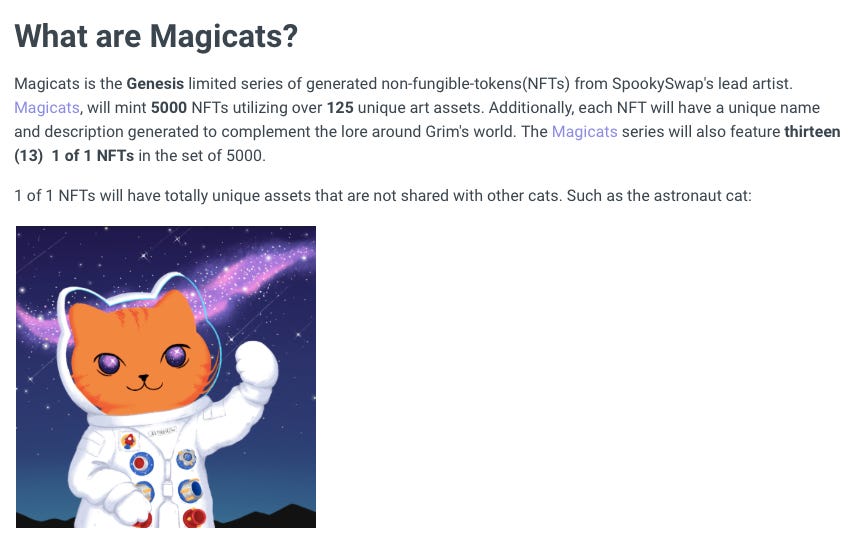

The difference between SpiritSwap and SpookySwap is that users are able to perform Limit Orders using Spooky. Users are also able to purchase NFTs called Magicats.

The BOO token is used for:

Governance: Token holders are able to vote on proposals that are listed on Snapshot. The voting value of BOO can differ depending on whether or not it is staked as a liquidity pair.

1 BOO staked as a liquidity pair = 5 voting points

1 BOO that is in your wallet or staked as a single token = 3 voting points

Buyback and Partner Pool Staking: Users have the ability to stake BOO tokens in the buyback xBOO pool and earn more BOO. Users can also earn other tokens.

Collateral: BOO tokens can be used as collateral on other protocols.

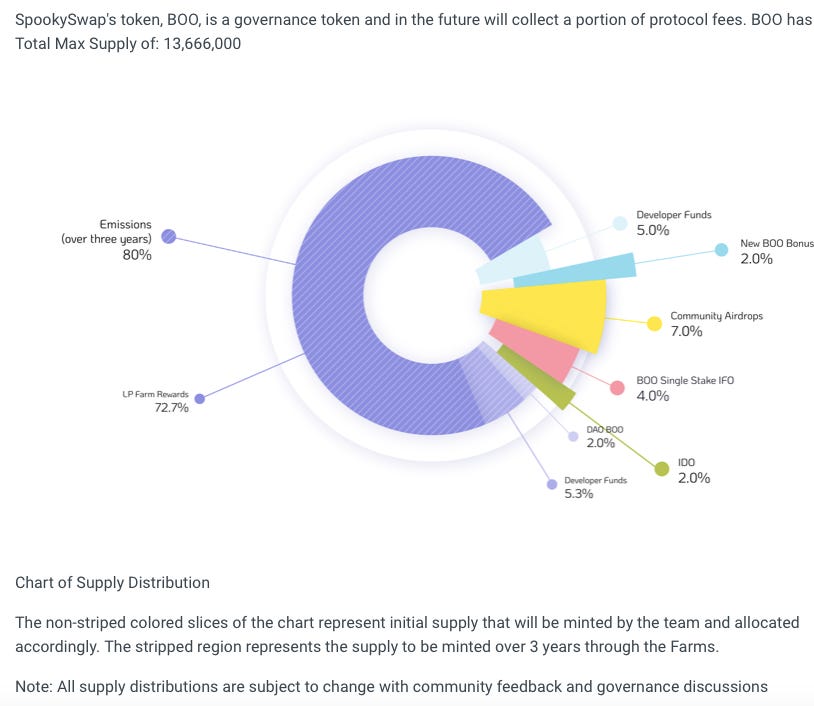

The distribution method of the BOO token is very reasonable.

The developers receive 10.3% of the allocation. Out of the 10.3%, 5% were allocated with a 365 day lockup period. The other 5.3% will be allocated throughout the 3-year admission period. 2% were allocated to the IDO. The community will receive 7% from airdrops. Most importantly, 72% of tokens will be allocated through LPFarm Rewards.

This is good because it will encourage token holders to participate in farming instead of immediately dumping.

SpookySwap has been performing very well in the last 7 days.

You can also see how SpookySwap measures up with some of the other great DEXs on Fantom.

ZooCoin

ZooCoin is an ecosystem of dApps (decentralized apps) that are built on Fantom Opera.

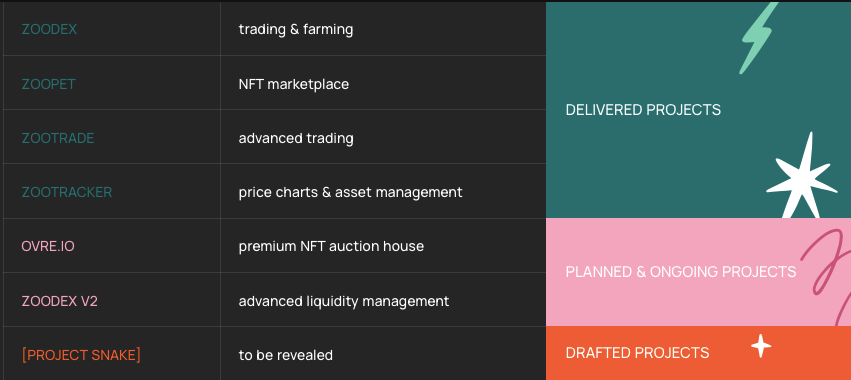

The different dApps that make up ZooCoin’s ecosystem are:

ZooDex: Zoo’s DEX that has a token verification system and embedded charts.

ZooTrade: Zoo’s investing and trading dApp that is also integrated.

ZooTracker: Zoo’s wallet that gives the user portfolio analytics and an asset dashboard.

ZooPet: Zoo’s NFT marketplace.

The native token of ZooCoin is ZOO:

There are other projects coming in the future.

In 2021, SpookySwap was one of the top projects in the Fantom ecosystem with a market cap under $100M.

Conclusion

These are a few of the projects in the Fantom ecosystem worth keeping an eye on. Keep in mind that the ecosystem is constantly growing.

My prediction is that 2022 will be a breakout year for the Fantom protocol. This means that a lot of focus will be placed on the projects that fall under the Fantom umbrella.

I’m not advising anyone to jump into any of these projects tomorrow, but this ecosystem will definitely be one to keep track of throughout the year.