Introduction

A common narrative that has been seen time and time again, is the tale of the legendary ETH killer. Since ETH’s inception, many protocols have attempted to dethrone the King of Smart Contracts, but none has succeeded. This time, a worthy opponent seems to have arrived. For those that haven’t been paying attention, Solana has been on an absolute warpath since August. The blockchain has risen to the number 6 cryptocurrency with a market cap of $52B.

Solana’s sudden rise has put every other L1 blockchain on notice. Naturally, the cryptocurrency community has been comparing Solana to Ethereum, and wondering who comes out on top? That’s what we’ll determine in this breakdown. Let the battle begin!

Gas Issues

First up, let’s talk about the Ethereum gas fees. One of the driving factors in Solana’s epic rise has largely been due to the enormous gas fees that people have been experiencing on ETH.

It was originally believed that EIP 1559 would serve as a temporary solution until the launch of ETH 2.0. Though ETH did become somewhat deflationary, the gas fees have been some of the highest we’ve seen.

Crypto Cobain and Sartoshi masterfully articulate the overall sentiment around the ETH gas fees that the space has been putting up with.

In other words, the gas is just too damn high.

In response, people have started migrating to Solana.

Speed

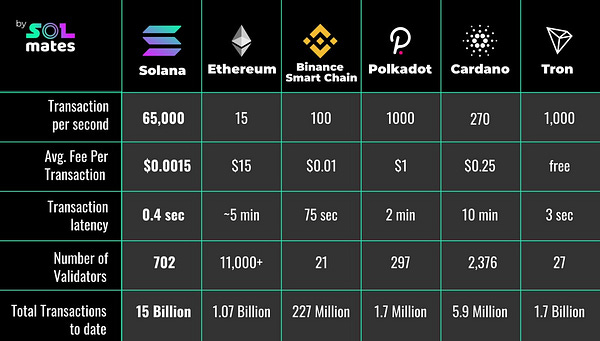

Solana’s TPS not only blows ETH’s TPS out of the water, it smokes every other L1 as well.

It not only wins in TPS, it dominates every other category.

Volume

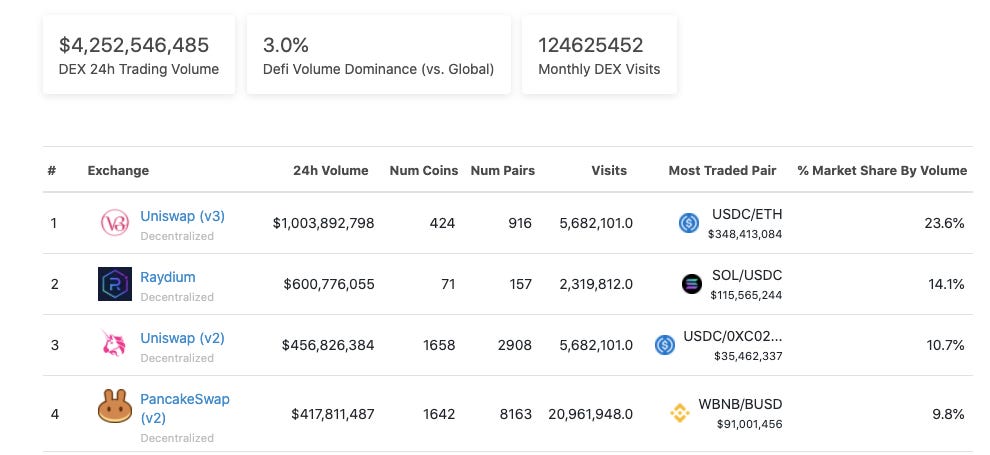

Uniswap(Ethereum) is still outpacing Raydium (Solana) in daily volume, but Raydium is fastly approaching Uniswap’s volume.

It also has to be taken into account that Raydium was launched in February of 2021, while Uniswap was launched September of 2020.

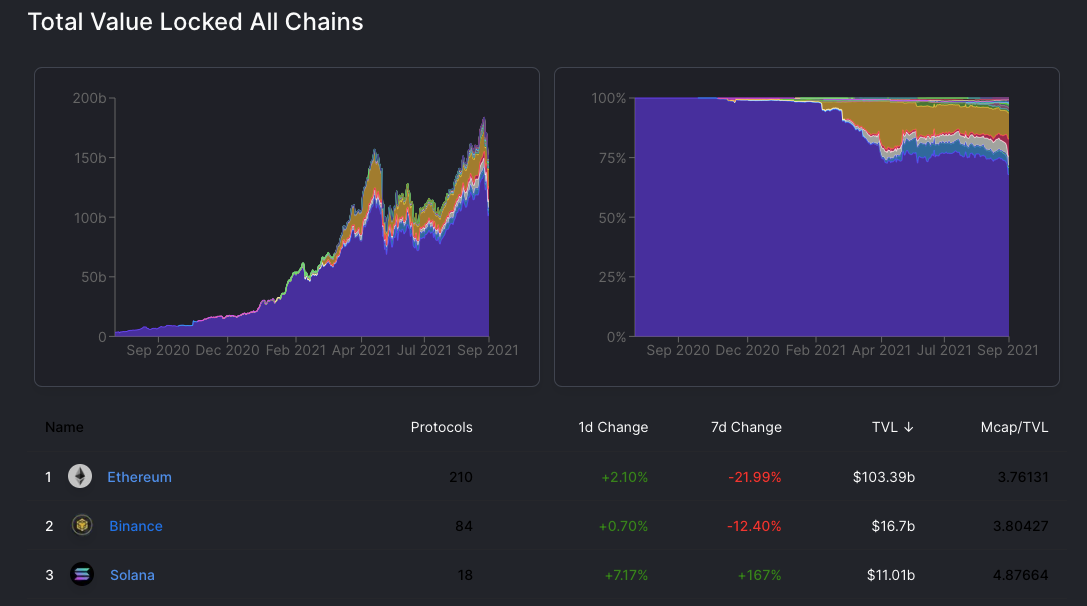

When we look at Defi Llama, Ethereum’s TVL is still almost 10x more than Solana’s TVL. So, there is still a significant mountain to climb to me

However, one thing to note is that out of the top 3 chains, Solana is the only one with a positive 7d change to the tune of 167%.

If Solana’s TVL continues to grow at this rate, we could easily see a 10x increase by winter. Of course, this is assuming that Ethereum’s TVL continues to slowly decline or stagnate which more than likely won’t be the case.

Sam Vs Vitalik

Everyone is familiar with the brilliance of Vitalik. He founded Ethereum back in December of 2015 when he was only 19 years old. He has played a primary role in building the blockchain into the $390B behemoth that we all know and love – or hate.

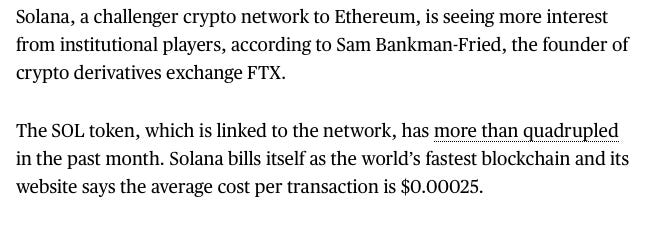

His competitor, 29 year old Sam Bankman-Fried, is also touted as a superstar and one of the brightest minds within the cryptocurrency community.

Sam is the founder and CEO of FTX, which is one of the largest cryptocurrency exchanges in the space. He is also the founder of Alameda research, a quantitative cryptocurrency trading firm where he manages approximately $2.5B worth of assets. He is said to have already amassed a fortune of $10B.

Sam is not the founder of Solana. Instead he is one of the largest investors and supporters of the blockchain. He is also the unofficial face and spokesman.

The two are eerily similar in their capability to build amazing projects. However, Sam seems to be capturing the hearts and minds of the institutions.

What makes Sam’s support of Solana such a threat is that Sam is not looking at Ethereum, he’s looking PAST Ethereum.

Sam’s investment into Solana was a calculated move. Back in December, Sam published a long Twitter thread detailing a conversation that he had with Vitalik about the different L1 blockchains and what makes them better or worse.

NFTs

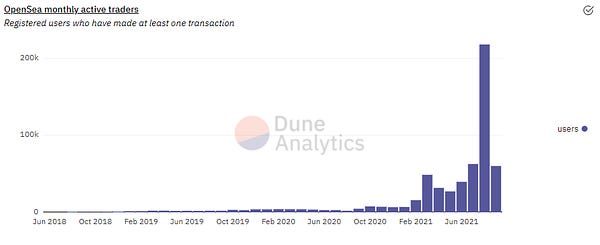

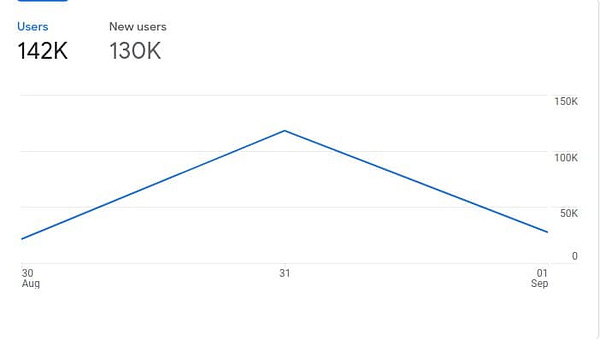

At the beginning of the month, fellow YouTuber Giancarlo noticed that the gap between Ethereum NFT purchasers vs Solana NFT buyers is closing.

After misstating that the Aurory drop had 50k buyers lined up to mint an NFT, Aurory quickly responded and informed him that they in fact had closer to 118k buyers waiting.

Moonrock Capital also announced that they spent approximately $257k to acquire a SolPunk and $1.1M to acquire a Degen Ape.

Ethereum still holds the title for the most expensive Crypto Punks sales, with Crypto Punk 7523 being the number one sale at $11.7M. A counter argument to this point is that Crypto Punks have been in existence since 2017. Degen Apes only launched last month.

Could Moonrock’s purchase be the first shot that triggers a huge influx of capital into Solana NFTs?

To be fair, there are more bullish examples we can point to – Bored Apes Yacht Club, CyberKongz, and The Doge Pound – that would possibly dispel any doubts about ETH NFTs. However, the high gas fees are causing prospective buyers to flee to other L1s.

EVM Compatibility

Another thing people are not pointing out is Solana’s growth despite its lack of EVM compatibility.

For those that are unaware, EVM compatibility is critical because it allows any Ethereum protocol to work on the Solana blockchain.

It was announced back in July that Neon Labs was launching an EVM solution on Solana’s testnet.

The deployment to the testnet seems to have gone well. Angel Dao recently tweeted out a video of a tutorial showing developers how to set up proxy nodes and contract development.

Needless to say, if Neon and Solana can continue to successfully roll this solution out to Solana’s mainnet anytime soon, it could lead to more Solana dominance.

Conclusion

Now that we’ve covered all of the variables to prove a bullish or bearish case for the rise of Solana and the fall of Ethereum, the natural question is, who wins?

The answer is more complex than you think. Right now, ETH is on the clock. The much anticipated release of ETH 2.0 within the coming months could make the entire “ETH killer” narrative nothing more than a laughable myth.

Naturally, Solana is still behind in metrics, but the rate at which it’s gaining traction and support should be a cause of concern for ETH maxis. Solana clearly did not come to play.

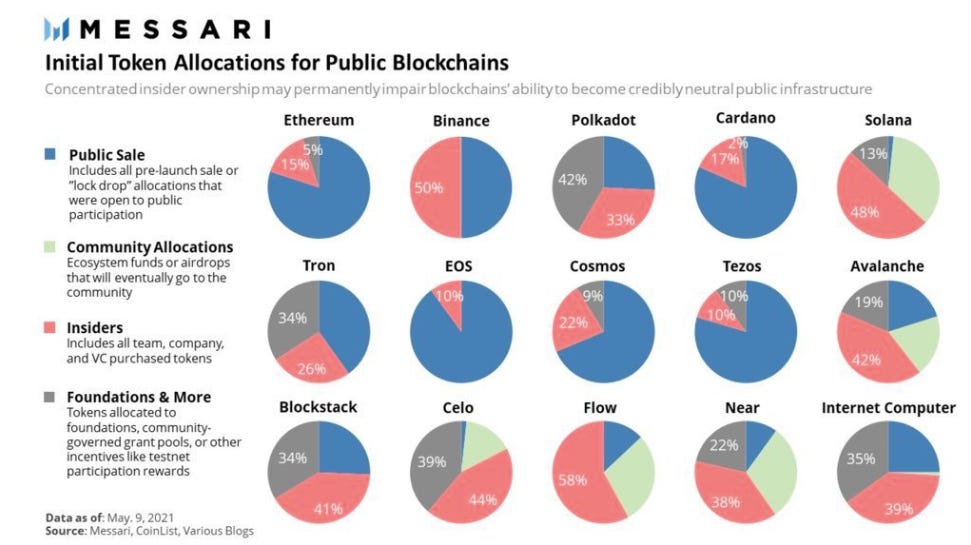

Lastly, it would be disingenuous to not point out that Solana is technically the second most centralized blockchain with 48% of tokens being allocated to Insiders. I believe in the future this will start to matter less as the chain grows.