Introduction

You might ask yourself, why talk about real estate when this channel has been all about crypto and the digital economy? The reason is simple: Crypto is not a niche asset class anymore that only tech nerds and speculators care about – in the last few years, it has turned into a legitimate asset class, respected and followed closely by investors and “macro experts.” And while crypto is a great “macro indicator” for risk on and off environments, it is also crucial that crypto investors understand the macro environment and how it moves the prices of our precious digital assets.

Thus, today we will look at an asset class of paramount importance to global financial stability: real estate. In fact, real estate is by far the most significant asset class, and every hiccup in housing has serious ripple effects throughout the economy and financial markets. Let’s jump in and look at what a historic and precarious position the real estate market is finding itself in currently and why it matters for crypto.

Real Estate: A Global Asset Bubble of Epic Proportions

As seen in the graphic below, real estate is the largest asset class in the world (absolute numbers are hard to gauge, and there are different methodologies, but the relative market cap comparison says it all).

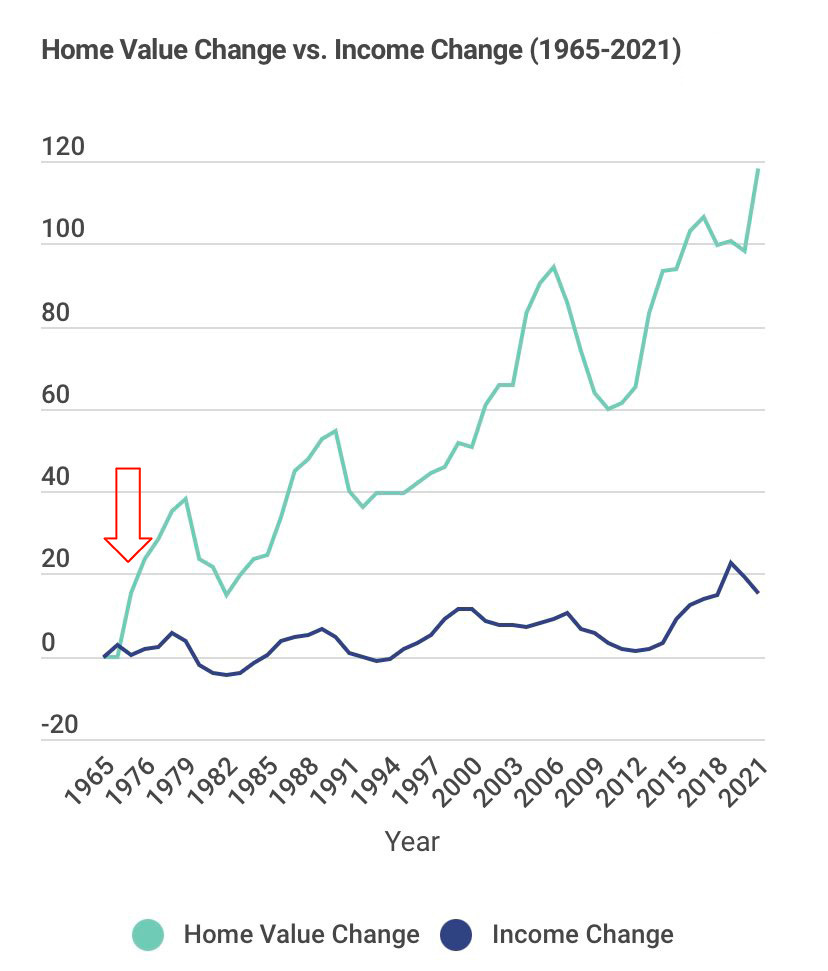

Spurred by monetary debasement and asset inflation, global real estate has turned into a massive asset bubble (see the world’s biggest real estate bubbles below).

Has the Housing Crash Started?

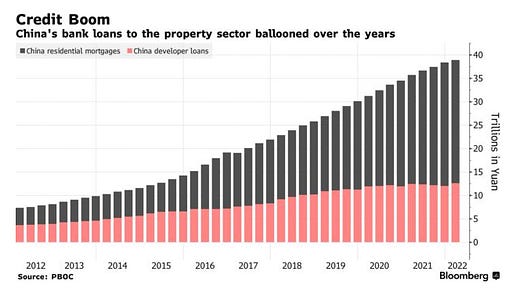

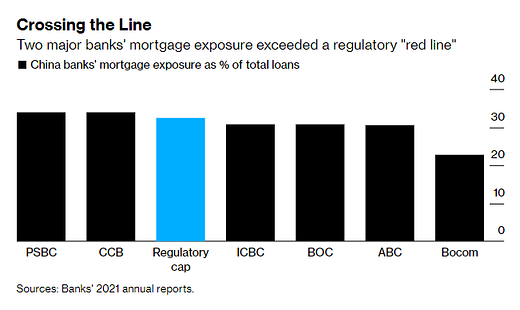

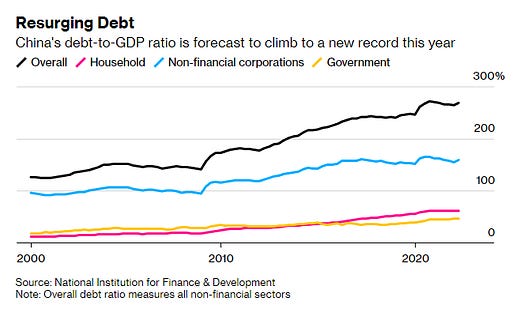

Certainly, we all remember the headlines earlier this year when Evergrande and other large Chinese real estate developers were on the brink of collapse – spreading fear of global contagion in financial markets. While things have been somewhat contained, the Chinese real estate collapse has had BIG implications for the world economy. If China sneezes, the world gets a cold...

It’s important to be aware that China has been leading the world in many aspects in recent months and years: They have been the first to be hit by Covid, and the Chinese economy has been in a recession for months already while the West is still teetering on the edge of a recession. It’s only a question of time until both a recession and housing correction become a reality in the US and Europe.

In fact, there are many signs that the real estate market in the US is slowing at an unprecedented speed.

No matter if you call it a crash, correction or downturn, the real estate market is going through a sharp slowdown.

Now that we know that real estate is entering a “corrective phase,” should we worry about an 08-style housing crash? The answer is likely no, mainly for one reason: While before 2008, many homeowners had bad credit scores with subprime mortgages AND relied on variable rates, today, average credit scores are much higher, and fixed yields have overtaken variable yields. This means that while we could experience a 10, 20, or even 30% correction in average home prices, it’s unlikely that we will see a full-on housing crash.

One factor that speaks for a sharper housing correction is the fact that consumer sentiment is already at record lows while housing prices are still printing all-time highs. Once prices drop, bad consumer sentiment could exacerbate panic-selling. Many Americans have their wealth tied up in real estate and don’t want to see their home values drop (after their stock and crypto portfolios have already declined materially this year).

Of course, in every crisis there lies opportunity, and a housing crash (or correction) will be a much longed-for opportunity for Millenials who have been priced out of the real estate market in recent years. Will they get the price discounts they desire, or will Blackstone and Co. scoop up (see Tweet below) all discounted properties and leave Millenials waiting for lower prices again?

What This Means for Crypto

As we stated in the beginning, real estate is the largest and structurally most crucial asset class, with many Americans having most of their net worth being their house (and many taking out loans against it). Therefore, a housing crash or correction should significantly impact both investing and spending behavior. If people feel that their net worth is declining, they will spend less – thus hurting the economy and, subsequently, stocks.

In addition, homeowners will likely not be willing to make risky investment decisions, which could have big implications for the crypto market. A crypto bull market is only possible if we see new money enter the space, and a slowing housing market could be a significant headwind. Therefore, patience will be required for crypto bulls. At the same time, macro factors like a real estate correction could lead to excellent buying opportunities in crypto.

On the bright side, crypto and stocks – while being hit hard in the first half of 2022 – could recover BEFORE we see a low in the housing market. Housing prices tend to lag equities and economic drivers by 12 months. This means we could witness the lows of crypto and equities while real estate continues its downturn.

Interestingly, JPMorgan strategists have recently stated that crypto has usurped real estate as their “preferred alternative asset class” and that the recent liquidation-induced market crash offered a "good entry point" for longer-term investors.

this story aged well