Introduction

It has been another relatively quiet day in crypto land: No major news and mostly sideways price action. Adding a little excitement is the price action of the “Andre Cronje projects” FTM and YFI with the rest of the markets in neutral territory.

However, the multi-chain DeFi space is heating up…

Market Outlook

From a macro technical perspective, the BTC chart is certainly looking much friendlier than just a few weeks ago. BTC managed to break key resistance and now finds itself again in a weekly uptrend.

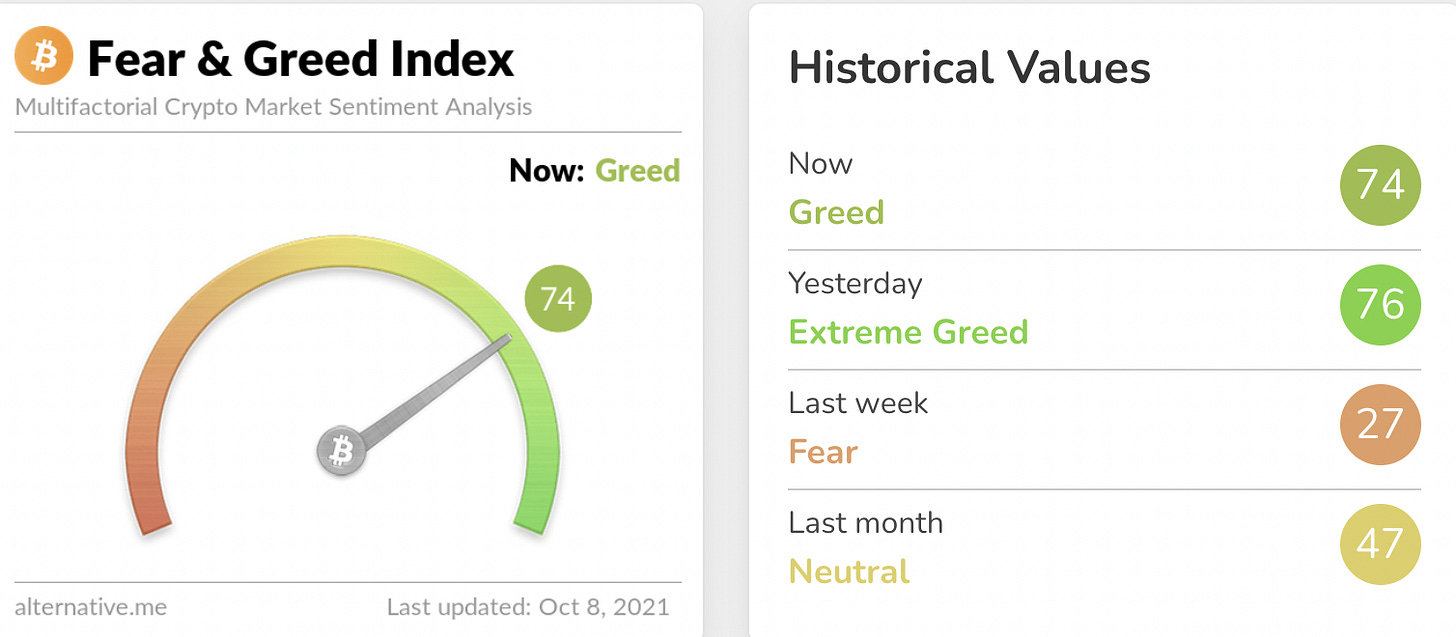

The newly formed uptrend on the weekly chart doesn’t mean however that a short-term pullback is not on the cards, especially now that the Fear & Greed Index is showing 74 (as opposed to 27 just last week!)

A “Quasi” Bitcoin ETF Gets Approved by the SEC

Is it a sign of what’s to come? This week the SEC approved an ETF for companies holding large amounts of Bitcoin, called the “Volt Bitcoin Revolution ETF.” It’s certainly not quite a Bitcoin ETF just yet but the closest we have come so far.

Let’s see if a Bitcoin futures ETF gets approved next.🤞 As Bloomberg reported today, the decision for four pending ETF applications is coming up in the next weeks and months.

However, experts have suggested that the decision is likely to be made at the end of the year or in Q1 2022.

While it’s not a reality, it’s important to think about both the short- and longer-term impacts the approval of a Bitcoin futures ETF could have:

Yearn Finance Goes Multi-Chain

The last few weeks have shown that multi-chain is the future – and projects that are not open to experimenting with other L1s (or L2s) will be left behind. Leading the pack of DeFi blue chips expanding from Ethereum to other chains are Sushiswap (with a record 14 chain integrations!), Curve, and Aave.

Newly joining the multi-chain party is now Yearn Finance, which clearly doesn't want to lose its dominance in the yield aggregation space. The first alternative L1 Yearn is moving to is… Fantom. But more are to come!

*wen arbitrum, optimism, polygon, avalanche?* There’s more multichain fun coming soon. Ultimately, we’d love to bring Yearn to any chain where we can safely operate and simplify the process of earning yield for users and partners.

And just because it’s such an eye-popping trend: Every new protocol implementation on alternative L1s leads to significantly increased throughputs for bridging protocols such as Anyswap…

Abracadabra & MIM Are Taking the Cross-Chain Space by Storm

DeFi magician Daniele Sesta has played a major role in growing the cross-chain crypto ecosystem. The constant innovations he and his team are pushing out bring multi-chain DeFi closer to the boundaries of imagination. They have managed to produce new DeFi blue chips at a breathtaking pace.

Especially, the growth of Abracadabra’s multi-chain stablecoin MIM has been impressive. It has moved to become the 7th largest stablecoins in a span of a few weeks!

Day by day Daniele and his team are improving the UX of their cross-chain DeFi ecosystem, forging new partnerships, and providing new attractive incentives for liquidity and users.

By the way: You can still earn high double-digit yields on your stablecoins on Abracadabra.money, you just have to take the plunge and bridge your tokens to Fantom first…

Where the Multi-Chain Space Is Headed Next

In the last few weeks and months, we have seen a lot of excitement around emerging L1 ecosystems: Solana, Avalanche, Fantom, and Co. have deployed massive incentive programs and attracted many projects, users, and tons of capital.

The question arises: What happens when these gigantic incentive programs dry up? Only L1s that offer genuine innovation (new DeFi or NFT primitives) or a significantly better UX (gas fees, bridges, etc.) are going to retain users and liquidity. When it comes to the former, the Ethereum ecosystem (including EVM-compatible chains) is certainly in the lead.

Regarding the latter, we will need to see a lot of improvement in onboarding and UX from L1s in order to bring new users on board (and not just degen yield farmers who know how to jump from chain to chain). Which chain will be in the lead in this regard?