Introduction

Today, Bitcoin has proven its right to exist once more: In times of peak uncertainty in the global financial markets, BTC is showing incredible strength, providing the “safe haven” it’s intended to be.

Most importantly, Bitcoin has surpassed a market cap of $1 trillion once more – an important symbolic achievement in being perceived as a global macro asset!

Bitcoin Is Showing Strength

After BTC smashed through critical price levels today, looking at liquidated shorts must give a feeling of satisfaction to every Bitcoin holder…

However, today’s BTC pump seems to have been mostly spot-driven, which makes sense with open interest being rather muted and liquid BTC supply at record lows.

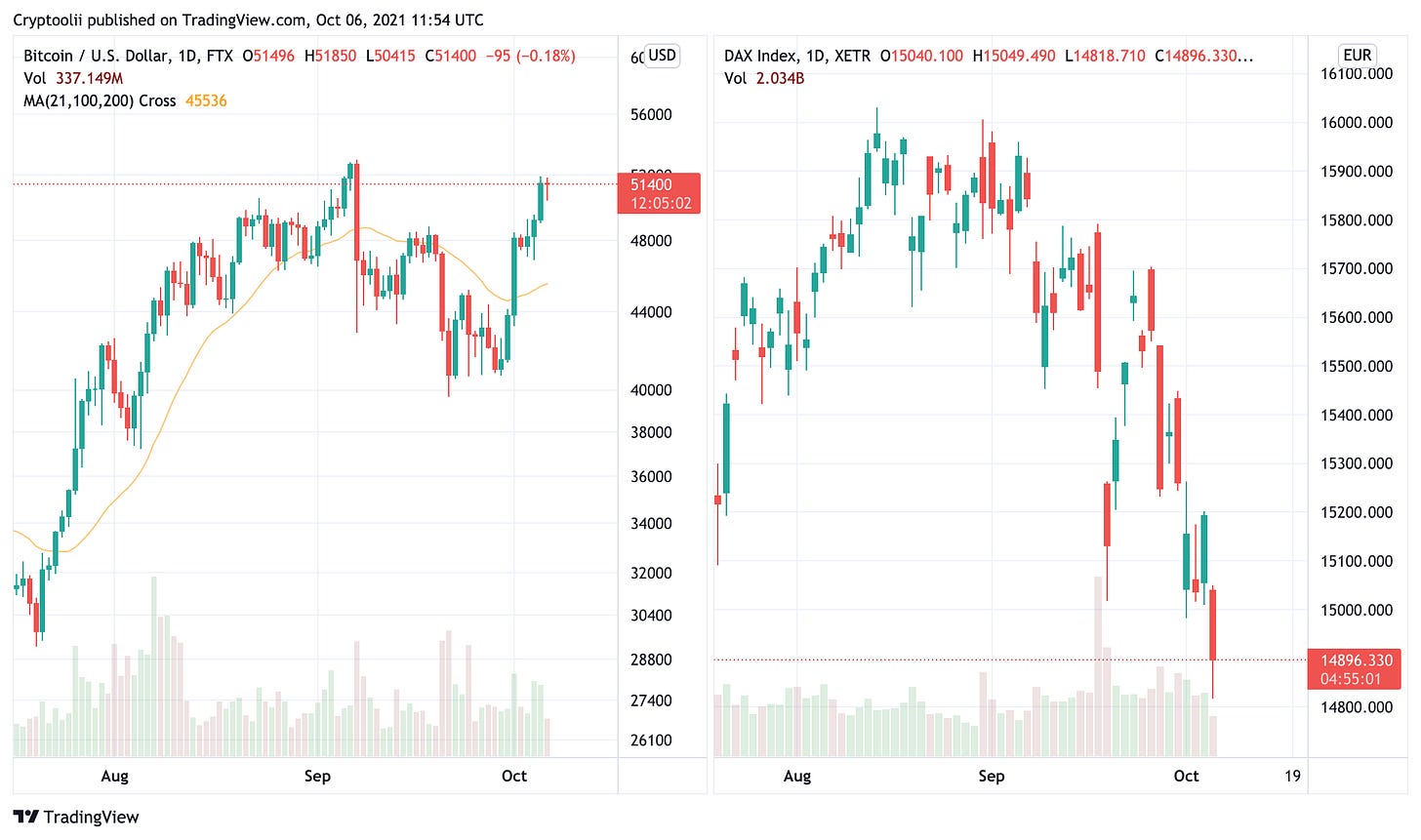

The resilience BTC is showing while stock prices are tumbling is simply stunning. Just look at the comparison of the BTC with the chart of the DAX below (since American markets have yet to open at the time of writing): Stock markets are in a clear downtrend, while Bitcoin has entered a short-term uptrend.

For close observers of all asset markets, the current strength of BTC is quite remarkable.

BTC’s recent strength in time of macro uncertainty could have different reasons: The recent spike in inflation metrics, dwindling trust in the US’ ability to keep its fiscal and monetary policy in check, and of course, the continued onboarding of institutional investors who seek BTC as a “system hedge” – in other words, a way to get out of the shaky stock markets.

Even investing legend George Soros, "the man who broke the Bank of England", is feeling uneasy in the stock markets and has confirmed (through the CIO of the $27 billion Soros Fund Management family office) to hold Bitcoin today. It is the first on-the-record confirmation from Soros to be holding crypto

Regulation Yes, Banning No

In a hearing yesterday, Gary Gensler stated that the SEC had no intention to ban crypto – only to regulate it. What doesn’t come much as a surprise is an important statement nevertheless and could give Bitcoin an even stronger boost, since it’s the crypto asset least in the crosshairs of regulators.

Below Maya Zehavi is laying out a possible scenario for the next few weeks. However, it will depend on the severity of the regulatory actions to really get a flight from stablecoins and DeFi, leading to a crash of the broader altcoin market.

With the lingering uncertainty, BTC really seems to be the safer play until the regulatory FUD gets resolved (at least that’s the thinking of institutional investors).

While the “Bitcoin over stablecoins and DeFi” scenario might certainly play out in the short- to midterm, stablecoins and DeFi are not going anywhere – and it seems like the regulators agree (see today’s Reuters headline below).

Regulators simply want to bring stablecoins into a regulated framework – which is far from eradicating or banning them. Of course, this will lead to tension and a restructuring of the current stablecoin landscape. But eventually, once the regulatory approval is here and the floodgates to stablecoins are opened, a limitless amount of money can pour into the crypto markets...

Source: Reuters

The proposals, put out to public consultation before being finalised early next year, put into practice what regulators have long called for: the same rules for the same type of business and accompanying risks.

Ethereum Is Gaining Major Institutional Adoption

Before 2021, the common belief of banks and corporations was: “Blockchain yes, crypto no.” This seems to be shifting towards the realization that public blockchains with a token-incentived model such as Etherereum are clearly superior to siloed private blockchain networks.

The Richest Under 30 Year Old in the World – a Crypto Entrepreneur

It’s incredible what crypto – and FTX-founder Sam Bankman-Fried in particular – have achieved in a short period of relentless building and innovating.

Extreme Scenarios – and How to Invest Accordingly

In below’s Tweet, you see a scenario for the months to come outlined by popular crypto trader Michael van de Poppe. While my outlook aligns overall with his, I want to take the chance to clarify a few things regarding investing and risk management.

This type of extreme outlook is great for catching attention on social media – but more often than not reality will land somewhere different.

Most people have extreme scenarios in their heads, which makes sense to build a personal framework but should NOT be the only guide for making investing decisions. What if your analysis is wrong? Being prepared for DIFFERENT outcomes is key to successful investing. As Warren Waffet famously stated:

Rule number 1: Never lose money. Rule number 2: Don't forget rule number 1.

Anticipating the future correctly and investing sensibly are two separate things: You might be right 9 out of 10 times and still blow up in the end. It is here where risk management and position sizing come into play.

Experienced investors know that timing and quantifying a likely scenario is much harder than anticipating that "something will happen at some point in the near future". That’s why they rarely go “all-in”.

If you were “quite sure” that the crypto markets will have a good few months ahead, you might be invested 60 % in crypto (according to your conviction level and risk appetite), and have the rest in stablecoins, precious metals, or – yes, that’s also possible: fiat. A position in USD for example (even if only short- to midterm) is also a position. E.g. during a liquidity crisis such as in March 2020, cash is king.

Reminder: Leverage Trading Is a Game with Fire

For anyone new to the crypto space, leverage trading seems to have a magical attraction: It promises fast gains with hardly any effort. Most realize soon though that making money with leverage trading is hard – and not losing any even harder.

The story below is a reminder that leverage trading is a dangerous game that can destroy fortunes. Most people entering crypto would do much better just becoming crypto investors – and not touch leverage trading.