Introduction

It has been a quiet start to the week, especially price-whise (with some notable exceptions such as $AXS, $SOL and $LUNA). With the stock markets fearing the looming Evergrande insolvency and grappling with Europe’s energy crisis, we have seen little risk appetite in the broader investment landscape.

Despite the muted price action in crypto land, there is no shortage of interesting stories today. So, strap in!

Market Outlook

We have had this bullish pattern for ETH on the radar for many weeks now… Will it play out? Soon we will know.

A fractal worth noting can be seen in the Bitcoin’s difficulty ribbon chart. Take it with a grain of salt but if we saw 2018’s pattern repeat, we could expect some very bullish price action over the next few months.

Supply shock inbound (finally)?

We see several potential negative and positive catalysts on the horizon. While timing them is hard, it’s important to think about their potential short- vs. long-term implications. Be prepared for a rollercoaster ride!

On the Current Bull Market & Taking Profits

Nothing is more important in crypto than having a strategy in place BEFORE things go crazy. It’s much harder to stick to a plan when prices move quickly in either direction if you haven’t thought about it in advance. Even for seasoned crypto investors, it’s not always easy to not get caught up in their emotions – FOMO and FUD can be powerful!

Ari Paul does a good job putting his thinking about the current bull market and his take-profit strategy into perspective. Take from it what you will but there is certainly something to learn.

The Hypocrisy of Regulation

After the Panama papers in 2016, we now get a new scandal: the Pandora Papers. While the extent of the recent leak is immense, it basically shows that nothing has changed for the better in the last five years: Rich people continue to hide their money in secret off-shore accounts, and regulators do an excellent job at looking away.

But of course, crypto needs to be heavily regulated to protect the consumers… or was it the legacy financial system?

The ‘Merge' Is Coming

Yesterday we mentioned that after the ‘Merge’, ETH issuance would drastically decrease, making ETH’s monetary policy significantly “harder”. Guess what? Today, ETH developers have made an important step closer towards the transition to ETH 2.0.

A quick reminder that while the largest returns are certainly made with the right NFT and altcoin picks, there is a common denominator for a more passive and low-risk investing strategy: ETH.

Yes, there is also a LOT happening on emerging L1s such as Solana and Avalanche, but the majority of economically significant NFT and DeFi activity is still happening on Ethereum and L2s. Playing hot L1s can work out if you pick the right ones and nail timing – but betting on the Ethereum ecosystem is likely less risky on all times frames.

To put some misconceptions about ETH L2’s effect on ETH burning to rest: Yes, they offer lower gas fees than Ethereum L1 but no, this doesn’t diminish their overall ETH burning effect: While one individual transaction might burn less ETH on L2 than on L1, the cumulative effect is still significant.

Since L2 enables far more use cases and consequentially orders of magnitude more transactions than L1, there is also a substantial amount of ETH getting burnt by L2s…

At the same time, we see gas prices in Europe explode. Wait, in Europe? Of course, we are not talking about Ethereum gas fees but the energy crisis in Europe! 😉 Just a reminder that there can also be distruptions and massive price volatility outside of the crypto markets.

Of course, Crypto Twitter has been fast to jump in with jokes and memes.

Web3 Will Eat the Internet

For crypto-natives logging into dApps with MetaMask (or another wallet) has become the most natural thing in the world. No more linking of personal data, google or social media accounts. It’s easy to forget that 99% of the internet is yet to be disrupted by Web3 logins.

MATIC Farming Is Getting Juicier

For everyone bullish on MATIC and thinking about putting his or her MATIC to work: MATIC yield farming is getting more lucrative! On the occasion of Quickswap’s first anniversary, Polygon and Quickswap are ramping up the LP rewards on select farms.

Don’t Miss an Airdrop with This Tool

We have told you several times that trying out new protocols in anticipation of retrospective airdrops is a lucrative strategy. But how should you know which protocols to try out? @JeanBrasse_ has created an excellent sheet with numerous potential airdrop candidates.

Putting Axie’s Success Into Perspective

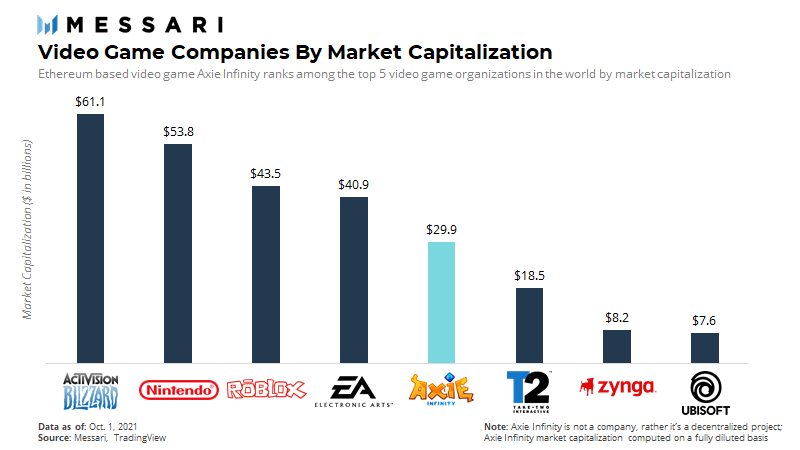

Sometimes in crypto, it’s easy to forget how far the space has come in the mere decade of its existence. NFT gaming trailblazer Axie Infinity is probably the most impressive example of a successful crypto project. What the project has achieved since its inception in 2018 (only three years ago…) is simply stunning!

It’s mind-boggling to imagine where the blockchain gaming space would be in a few years, with just a bit more time of development… It’s such a disruptive and exponential trend that crypto gaming projects will likely blow all legacy gaming companies completely out of the water – if they don’t jump onto the crypto bandwagon in time.