Introduction

It’s fascinating to see how small, intra-day moves in Bitcoin’s price can change sentiment in the blink of an eye. From euphoria to fear and now optimism again – we have seen it all in the last three days.

Fundamentals-based investors with a reasonably low time preference will look through this noise and focus on what really matters: Fundamental catalysts as well as the macro on-chain and price structure, which ultimately indicates when the party is over.

So, is it time to be fearful or greedy right now? Given that we find ourselves in the middle spectrum of most on-chain and price models, it’s neither nor. Ideal entries with lower risk lie far behind us, while there is still tremendous potential upside to be had going forward… Play your cards well!

The Dog Coin Wars #2

In the last few days, one event has caught a lot of attention in crypto land: The mind-boggling rise of Shiba Inu which keeps shocking the crypto community. Today, SHIB even managed to “flip” its dog coin rival, DOGE…

Make of it what you will but some believe that the current dog coin mania is not as problematic as it turned out to be last May…

More Signs That Retail Is Coming

The meme coin pumps are one obvious sign that right now there is a lot of retail activity going on in crypto land. It’s a clear “orange flag” that signals a higher risk level in the current market. On a more positive note, higher retail participation can also lead to some insane altcoin seasons, mostly not with a long-lasting effect however.

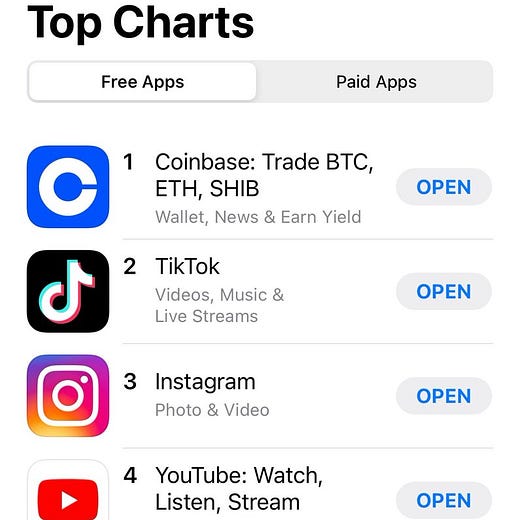

Another sign that retail investors are flocking in is the popularity of apps like Coinbase and Robinhood, obvious entry gates for retail. On the one hand this is great since it seems like crypto is going more and more mainstream. On the other hand it also raises some alarm bells in the short term as smart money usually tends to countertrade the retail crowds…

How to Spot the Macro Top #2

Two days ago we pointed out several data science models and charts that can help identify macro market tops and bottoms. Today, on-chain analyst Will Clemente wrote a very insightful thread on the same topic. Since it’s quite a long thread, feel free to check it out in its entirety here.

I encourage you to check out the rest of the indicators too!

MIM Listed on the First Centralized Exchange

Daniele Sesta’s ecosystem has been on a tear lately – and there is no stopping insight. Today, MIM, the fast-growing decentralized stablecoin in the Abracadabra ecosystem, has been listed on Bitfinex, one of the biggest exchanges worldwide.

By the way, the MIM pastures on Trader Joe have become even more attractive today…

The First Polkadot Crowdloan Opportunities

After we brought you several crowdloan opportunities on Kusama recently, it’s now time to get ready for the first Polkadot crowdloans! A promising project with high-profile backing that recently opened its waitlist for the first batch of parachain auctions is Parallel Finance.