October 25, 2021

The Positive News Keep Rolling in – Time to Be Cautious or Greedy?

Introduction

As soon as you think, there are no new catalysts to support the next bullish leg in the markets, we see fresh stories rolling in: Today, Mastercard went “all-in crypto” and announced to expand its support for various crypto services. If this is not bullish news, I don’t know what is…

Nonetheless, it’s never wise to trade based on news stories, and in today’s update, we want to highlight (again) the urgency to remain level-headed and grounded in the current markets. Too often have we seen that when everyone has their eyes on a certain positive or negative catalyst the markets (aka “smart money” or whales) tend to create a counter-movement in the short term… That’s when you want to jump in, not when everyone is bullish!

Market Watch & Outlook

In the last few days, we have witnessed a mild cooldown of Bitcoin and Ethereum, which gave quite a few altcoins room to run, nothing spectacular though. Among the biggest winners in the last 7 days have been RUNE (+62 %), CRV (+52 %), NEAR (also +52 %) – all calls by us – and… meme tokens.

Is the strong performance by SAFEMOON, SHIB, and Co. a warning sign, as it has been many times before? It certainly signals that some retail exuberance has reentered the market and in the short term, the risk of shakeouts is rising.

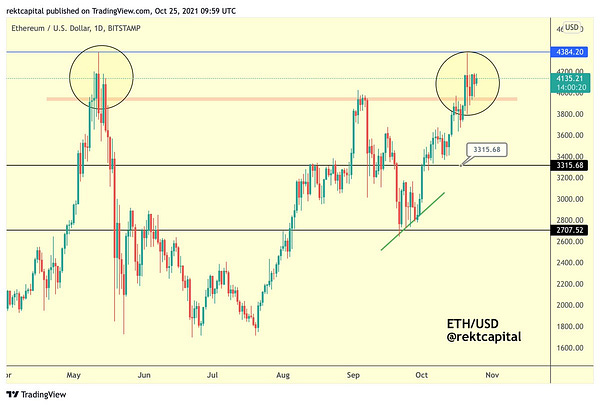

While on higher time frames, Bitcoin and Ethereum are looking solid, there are reasons to be cautious in the short term and at least be mentally prepared for some type of “washout”. Don’t forget that the longer we haven’t seen a red day with double-digit losers across the board, the more likely one will come at some point in the future.

Does that mean that you should sell everything and run for the hills now? Far from it, since we’re only talking about exercising some short-term caution. The risk of being left behind once a powerful alt-season kicks off is simply not worth betting everything on another dip – many have experienced this painfully during the first leg of the bull market in spring.

Learn to think in scenarios and probabilities, scale into your favorite projects on dips and be mentally prepared for volatility. This way you won’t react emotionally to whatever direction the markets take.

Now is also a good moment to reflect on your own mentality and emotions, since it’s so easy to be infected by general euphoria and greed (or fear) as we are seeing now across Crypto Twitter.

On a brighter note, there are undoubtedly also possible positive catalysts in the short term, a strong stock market could be one of them.

CRV’s Remarkable Performance

One of the best performers of the last 7 days has been CRV (+ 48%). It’s an impressive move for a “DeFi 1.0” token of which many have had a lackluster performance in the last few months, to say the least.

CRV’s performance is another great example of strong bullish divergence between fundamentals and price playing out after many weeks of forewarning. CRV’s tokenomics have significantly improved in recent weeks with the emission rate dropping and a ton of CRV being locked up. Now the price is catching up nicely!

Mastercard x Crypto: “The Crypto Economy Is about to Expand”

Arguably the biggest news of today is Mastercard’s further embracing of crypto. They obviously don’t want to let Visa get too far ahead in this future tech field…

Mastercard is preparing to announce that any of the thousands of banks and millions of merchants on its payments network can soon integrate crypto into their products.

That includes bitcoin wallets, credit and debit cards that earn rewards in crypto and enable digital assets to be spent, and loyalty programs where airline or hotel points can be converted into bitcoin.

Regulation Killing Crypto Firms? Think Again

Recently, crypto firms (especially centralized lending providers and exchanges) have come under increased regulatory scrutiny particularly in the US. Is it because regulators want to protect legacy finance (certainly not the consumers) or simply because they don’t understand the blockchain world enough?

Either way, if you thought a few regulatory scares would stop the blossoming crypto industry, then you don’t understand how the interlinkages between politics, economics, and power work. Crypto has crossed a critical threshold of influence with its $2.7 trillion market cap and backing from massive financial players… There is no way back.

Why We Shouldn’t Talk about Hyperinflation – According to “Experts”

Jack Dorsey’s Tweet about hyperinflation (if accurate or not is up for debate), has led to some fascinating responses, exposing the world view of many so-called “experts”.

Imagine if merely talking about hyperinflation could lead to the entire global economy imploding. Is Wired columnist Virginia Heffernan showing a clear lack of understanding of how our economic system works or is it an expression of how fragile this “house of cards” called fiat economy really is? Or maybe both?…

More Reasons to Opt-out of the Status Quo

Recently, we have seen a number of proposed policy actions in the US that have, to say it mildly, caused an outcry. After the $600 surveillance proposal, we have gotten a fresh “idea” presented by Secretary Yellen today.

China & Crypto: Not the End of the Story?

While China had already banned crypto several times since… 2013, the authoritarian state only started to “really” crackdown on crypto this summer. Crypto mining has been basically eradicated in mainland China since – with no sustainable impact on Bitcoin’s hash rate.

What no one would have expected is that China might already be U-turning again soon! Are they just doing it to be able to re-ban crypto again? 😆 Or is it because China has noticed what a grave geopolitical and economic mistake it committed? Either way, game theory seems to be playing out faster than anyone would have anticipated…