October 21, 2021

While Bitcoin Is Retesting, Ethereum Is Challenging Its Old All-Time High

While Bitcoin is retesting support after its impressive breakout yesterday, we have seen altcoins move quite a bit today. Particularly Ethereum tried to replicate what Bitcoin did yesterday: Break its old all-time high (around $4400) and enter price discovery. In case you wondered why ETH’s first attempt failed, here is the explanation 😉

Sassano what can we do to stop you from tweeting this week?

With Bitcoin dominance decreasing quite a bit today, many altcoins have posted single- to double-digit gains. Near and Celo, two emerging L1s we have pointed out recently, have been among the top performers.

Is this a trend to be resumed? Hard to say, but with Bitcoin dominance still in a bullish structure, it’s likely that we don’t get the “big alt-season” just yet.

In the Short Term, All Bets Are off

As CZ rightly points out, there will be a LOT of volatility, shakeouts, and “scam price action” in the coming weeks to shake out “paper-handers” and take only those with high conviction to the hallowed land of the next bull market leg.

From FOMO-induced bullish continuation to double-top fears or a massive leverage liquidation flush-out (which we have to expect at some point irrespective of fundamentals) – different short-term scenarios are in the cards and speculation on Crypto Twitter is running hot.

No matter what: If you positioned early enough in the cycle or bought the dip, you should be sitting pretty now, unfazed by the next short-term price action (taking some chips off the table is never wrong too!)

There are, of course, also still bears on Crypto Twitter (which is good since we don’t want consensus). One way or another, ALL scenarios – even if unlikely – should be in the back of your head.

If the fast-moving prices and (constant) uncertainty in the markets make you nervous, here is some good advice by Avalanche founder Emin Gün Siner:

God Candles on All Time Frames

Not just on the hourly time frame, we witnessed a powerful green candle yesterday that smashed through and beyond Bitcoin’s old all-time high. Zooming out to the weekly chart, we can see how impressive BTC’s run in October has been.

When looking at Bitcoin’s RSI we can see that we just reentered the red zone which means while risk levels are rising, there should still be ways to go!

The Bitcoin ETF Wave Is Rolling in

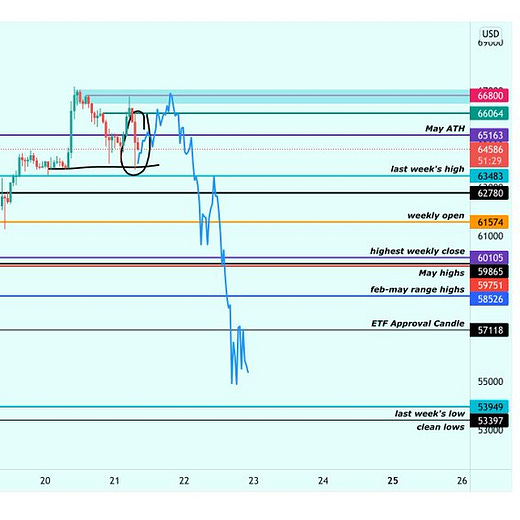

This week we have seen the first Bitcoin Futures ETF start trading in the US, a watershed moment that clearly hasn’t turned out to be a sell-the-news event but instead the catalyst for Bitcoin to push to new all-time highs.

The launch of the ProShares Bitcoin ETF has turned out to be highly successful, with huge demand by investors despite the seemingly apparent downsides of a Futures-based ETF. TradFi investors apparently don’t seem to care…

After the BITO ETF kicked off the ETF party on Tuesday, two more Bitcoin Futures ETFs will launch in the coming days! It’s going to be interesting to see if they can attract similar amounts of capital as the first mover BITO.

All of this is of course only laying the foundation for a hopefully soon to come spot Bitcoin ETF, which would be HUGE since it would attract tons of fresh retail and TradFi capital into the crypto market and it would be “forced” to buy and hold real Bitcoin.

What Bitcoin ETFs (spot ETFs even more so than Futures ETFs) will do to the crypto markets is clear: Besides creating important regulatory clarity (a factor not to be underestimated), they will attract a lot of sidelined capital from both retail and institutional investors, especially through intermediaries like financial advisors and brokers. The following news items are all from the last 24 hours:

Even with the recent ETF approval, there is still a lot of room for growth once we get even more regulatory clarity.

Better believe that Bitcoin is only the first but not the only cryptocurrency that will attract a lot of new capital. We have repeatedly reported that institutional investors are particularly attracted to innovative L1 ecosystems like Ethereum, Solana, Cardano, or Polygon (falling somewhere between L1 and L2). Seeing ecosystem-specific, institutional-grade funds being created is a clear sign where capital will flow in the comings months…

Meanwhile, Bloomberg analyst Mike McGlone (who gets the attention of many traditional investors) keeps painting a very bullish macro picture for Bitcoin.

We’re living in a time where crypto exchanges get multi-billion valuations and raise money from the biggest money bags in the world such as Blackrock. Imagine what the hundreds of millions of dollars raised by FTX will do? They will help onboard the next big cohort of mainstream crypto investors.

Or of course:

Countries Are Warming up to NFTs

In a pleasantly surprising move, Thailand has changed its tune on NFTs after appearing quite hostile earlier this year.

NFT Bridge Between Ethereum and Cardano

Cardano has had a slow start to its smart contract era but the NFT activity on Cardano is running in overdrive! Today’s announcement of IOHK, the main company building Cardano, to build an NFT bridge from Ethereum to Cardano is pouring oil into the already hot fire…

New NFT Marketplace on Solana

Not just Cardano’s also Solana’s NFT ecosystem has been on fire in the last weeks. Now, a new NFT marketplace has arrived in the Solana ecosystem powered by Raydium.