October 20, 2021

Bitcoin Smashing Its Old All-Time High with a "God Candle"

Introduction

Yes, here we go! Bitcoin has SMASHED through its old all-time high with a vengeance today 🤯 Congrats to everyone who hodled through this summer’s “bear market” or bought the dip…

In case you are still sitting on the sidelines or impatiently awaiting alt season, here is some advice by Grayscale CEO Barry Silbert 😉

While this is certainly a euphoric moment for every crypto holder (yes, also the time for altcoin degens will come), this doesn’t mean there will be smooth sailing from now on: Corrections and shakeouts are par for the course and the next FUD wave will certainly show its ugly head again. But remember: Retail is not here yet so there is still a ways to go in this bull market…

So, strap in for the ride, don’t forget to take profits on positions that have done well for you, and keep your eyes on this space, because the number of opportunities – especially in the altcoin space – in the next weeks will be tremendous.

Some Hopium For ETH Bulls

There is no doubt: Right now, Bitcoin is drawing all the attention, with ETH following at a slower pace. Historically, however, as soon as everyone has piled into BTC and the “crypto king” has made its major move, ETH started moving even more violently. It might take some time until ETH starts really going though since BTC’s run is likely not over yet (this doesn’t mean that ETH’s price won’t rise too, just not as much as BTC’s…)

It will strongly depend on the unfolding of different narratives in the coming months: Will BTC as a (finally) ETF-supported store of value remain the preferred bet for investors? Or will the innovation and ESG-narrative kick in again and lift Ethereum out of BTC’s shadow? It’s likely that both assets will do well in the comings months, the question is just: Which narrative will attract more capital?

The thread continues by illustrating the arguments with examples. Free free to dive deeper here.

Exposing “TradFi” Investors

It has been fun to watch Guggenheim’s CIO Scott Minerd flip flop and come out with one ridiculous Bitcoin prediction after the other in recent months. After first aiming for the moon when the markets were bullish last winter, he was quick to become a “paper-hander” during this summer’s market downturn. You can bet that he “bought high and sold low” as many average emotionally driven retail investors did. Imagine how stupid the likes of Minert must feel on the day Bitcoin breaks its all-time high…

What can we learn from this episode? Traditional investors, even if the richest and most successful in the world, don’t have an edge over retail crypto investors who build their conviction through the study of fundamentals.

“Digesting” the Facebook News

In the last few days, Facebook made a splash by announcing its crypto ambitions in a more pronounced way: The tech giant both launched a pilot for its cryptocurrency wallet and doubled down on its Metaverse plans. Even rebranding Facebook to a “Metaverse-friendly” name seems to be on the cards. It’s obvious that Facebook has recognized how big the opportunity of creating a Metaverse is and wants to go all-in now…

With Facebook being one of the most influential tech companies in the world, it didn’t take long until they provoked a wave of reactions – mainly pushback from politicians and the crypto community.

Just hours after Facebook’s release of the Novi wallet pilot in the US and Guatemala, a group of senators sent a letter to the tech company, urging Facebook to stop both its cryptocurrency wallet as well as its stablecoin efforts. It has to be seen to what extent Facebook will react to these drastic demands. The tech behemoth will likely not want to scramble its plans entirely unless forced…

This is a massive hindrance to the operations of Novi, but it can also be ignored by the company.

While some in the crypto community see particularly Facebook’s crypto wallet as a major potential catalyst for mainstream adoption, many voice concerns about Facebook’s plan for a centralized Metaverse.

Of course, memes were also not missing:

Why We Need Decentralized Infrastructure #2

For us who have been in the crypto space for quite some time, it is easy to see the need for decentralized infrastructure… It’s basically everywhere and stories like the following are reinforcing this belief.

Animoca Brands Is Climbing the Ranks

While Facebook is working on its centralized Metaverse, players WITHIN the crypto ecosystem are making massive strides in propelling the idea of a decentralized Metaverse ahead. Is Ubisoft, a major legacy gaming studio, being one of Animoca’s largest investors, a sign of the times?

It’s incredible what Animoca Brands, the undisputed NFT trailblazer, has already achieved in a couple of years… and we can’t wait to see where their efforts will lead us next.

Looking for Opportunities in the Polkadot Ecosystem

In the coming weeks and months, there will be no shortage of opportunities in Polkadot land, since Polkadot parachain auctions are set to kick off in November, and crowdloans on Kusama are increasing their frequency.

The key will be to detect potential winners early and have an eye on tokenomics, presale token releases, and hype cycles since there are also ways to play the Polkadot ecosystem wrongly and lose money…

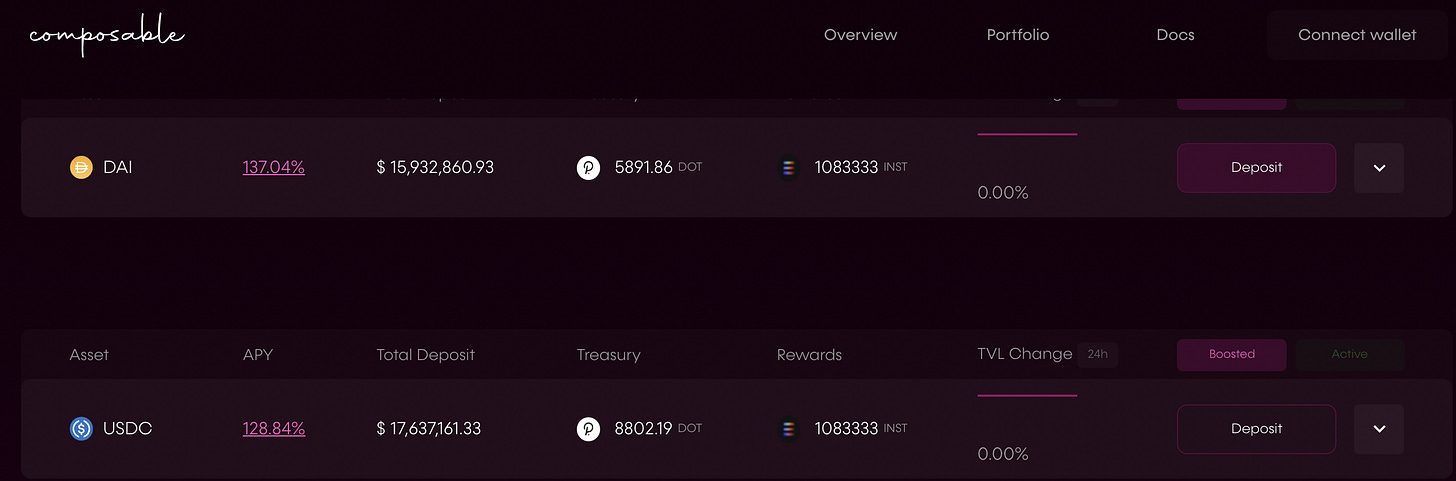

Composable Finance & Picasso

A very interesting project at the intersection of ETH Layer 2, L1s, and Polkadot that’s worth having on your radar is the cross-chain project Composable Finance. The project has been pushing ahead with cross-chain innovations, notably their bridge which is supporting more and more chains by the week.

Composable seeks to act as an optimal solution to enable cross-layer interoperability among Layer 1 & 2 networks, allowing them to communicate with each other and perform near-instantaneous asset swaps. Composable is building a variety of different components to facilitate an Ethereum multi-layer ecosystem.

Want to earn 100+% on your stablecoins and bet on this up-and-coming cross-chain interoperability project in the Polkadot ecosystem? Then the newly launched “stablecoin strategies” with fresh liquidity mining rewards by Composable Finance might be of interest to you. (Be aware of the gas fees though since the farms run on Ethereum)

If you want you can go a step further and participate in the Picasso crowdloan campaign which recently reopened for contributions. Be aware that participating in a crowdloan brings additional risks since your invested capital will be locked up for many months in return for PICA tokens (IF the project wins a parachain slot).

If you want to participate, you should hurry, since there is an early-bird bonus that lasts until tomorrow, October 21 at 10pm CET.

Will DeFi Yields Signal the Next Market Top?

What we have seen during the last months’ bullish and bearish trends, is that overall, DeFi yields have gone up and down alongside the market. This makes sense since most DeFi yields are dependant on the performance of the underlying tokens as well as the willingness of market participants to borrow capital (aka risk aversion).

Right now, DeFi yields are nowhere near the levels we saw during last spring’s altcoin season. Will they reach these levels again before we see a major top in the markets? It is a likely scenario but let’s not bet the farm on this indicator alone since DeFi yields are also driven by other factors such as overall market saturation and capital efficiency.

The Terra Ecosystem Is Boiling up

Speaking of DeFi yields, the constant, high yields in the Terra ecosystem (mainly Anchor’s fixed 20% APY on UST) has been a major cause for the ecosystem’s massive TVL growth and LUNA’s parabolic price rise. Now the next major catalyst is looming:

Among the first to embrace Terra’s multi-chain strategy is (obviously) “DeFi 2.0” genius Daniele Sesta and his MIM/SPELL ecosystem.

Be Careful in NFT Land

Scams are nothing new in the crypto and NFT space. The problem is that the schemes are constantly evolving and becoming more and more sophisticated. Even for seasoned crypto users, it can sometimes be hard to detect scams… Be careful out there!