Introduction

What a choppy day it has been: Down, sideways, up – both the crypto and stock markets are clearly looking for direction. What can we do? Zoom out and chill, while we wait to see fundamentally strong projects have their time in the light...

And of course, keep an eye on important stories, of which there have been plenty today!

It’s Official: Polkadot Season Is Inbound!

We finally got clarification on when parachains on Polkadot will go live: in December! As we anticipated last week, Polkadot founder Gavin Wood made the highly awaited announcement at the Polkadot Developer Conference today.

This important announcement could mark the start to Polkadot season, with DOT already mildly up on the day (6%) and the week (12%). Expect Polkadot ecosystem projects to run next…

“Transitionary” Inflation Is Stickier than Central Banks Would Like

Today’s highly anticipated CPI data release has shown what everyone (except some central bankers) was expecting: Inflation remains high despite declining base effects.

While we don’t know how long this current global supply chain crisis will last, for the time being, it will keep putting central banks in a very uncomfortable spot: Should they start fighting inflation (and crash the global economy) or keep playing down inflation (with all the negative effects for the real economy and middle-class we are seeing right now)? It seems like a situation with no good outcomes…

Jumping head-first into hard assets such as Bitcoin was the BEST decision anyone could have made in March 2020 (or anytime in the 10 years prior for that matter), when central banks globally started with unprecedented money printing.

Now, however, things get trickier for investors, since 1: inflation is to a big part already priced in (e.g., we see higher prices everywhere) and 2: at some point, high inflation inevitably leads to a reaction by central banks. This is is why at the current moment, we find ourselves in a very paradoxical situation, where the dollar is showing strength while risk assets such as stocks, gold, or crypto are facing uncertainty.

We’ll have to keep an eye on inflation, economic growth, and central bank actions to gauge when favorable investing environments or buy-the-dip opportunities could arise.

There is no easy way forward since crypto is deeply interconnected with traditional markets. Let’s hope that crypto can keep its relative strength over other asset classes as it has proven in recent weeks!

Proving Bitcoin’s Resiliency: The Effects of the Chinese Mining Ban

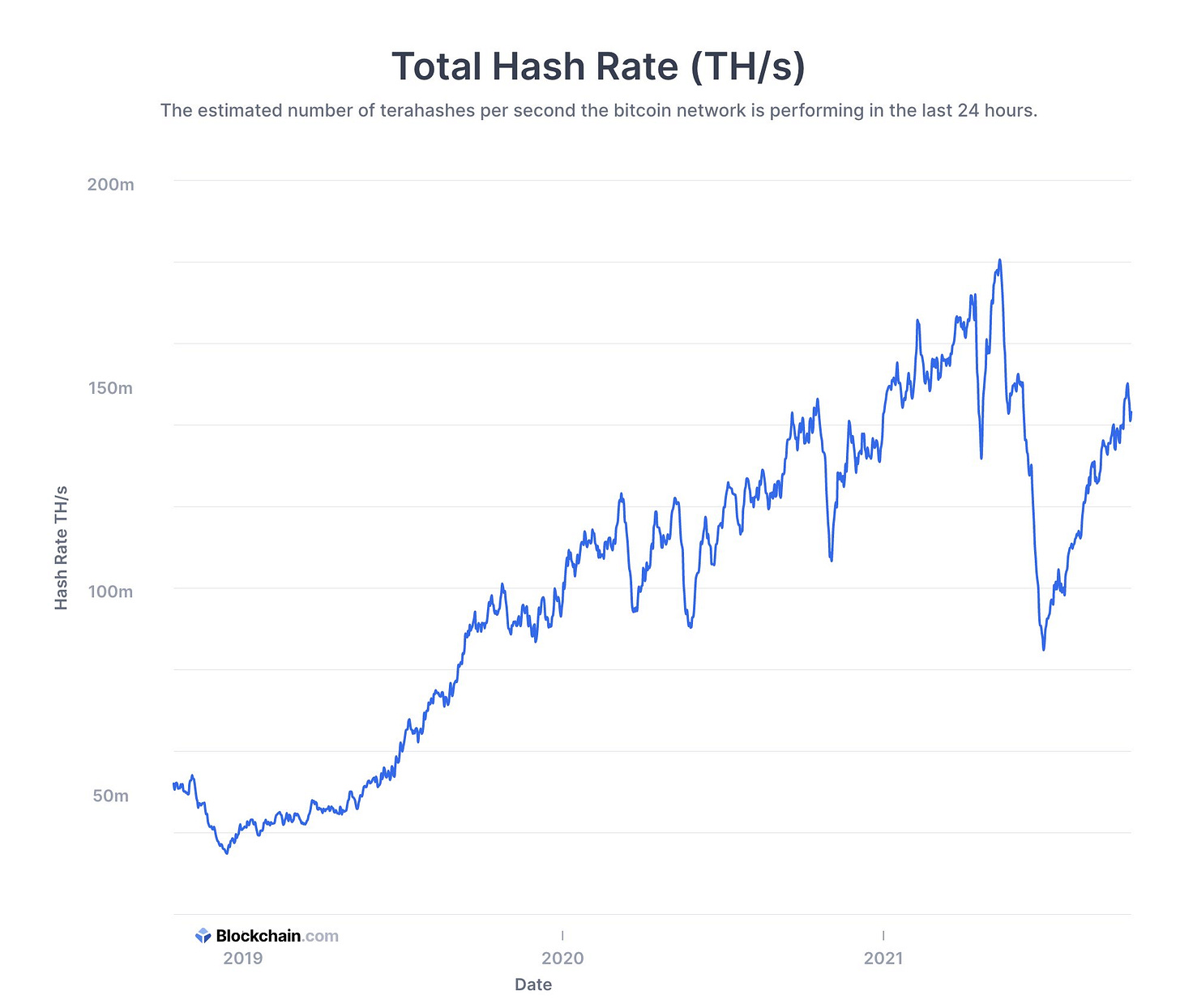

China’s rigorous crackdown on Bitcoin mining this summer led to a lot of FUD in the crypto community. To a certain extent, this is understandable, since China’s dominance both in mining and crypto investing was significant and a complete eradication of mining in China was undoubtedly going to send shockwaves through the crypto space – which it did for several weeks.

While the ripple effects took some time to digest (with a lot of Chinese selling pressure to be absorbed), Bitcoin mining bounced back quickly and a new “equilibrium” of global Bitcoin hash rate distribution has been reached.

China has dropped from nearly 75% of global Bitcoin hash rate in September 2019, to virtually zero.

All in all, the Chinese mining crackdown has proven how resilient Bitcoin is in the face of an attack by one of the largest and most powerful powers in the world.

DeFi 2.0 – Or Why Crypto Investors Have to Constantly Adapt

In the last few days, we have seen a new buzzword emerge: “DeFi 2.0”. Is it just a fad or is there more behind this trend?

But what actually is DeFi 2.0? It’s not so much about DeFi protocols being new but more about their way of operating:

Of course, this current definition is not easy for everyone to wrap their heads around. Hence, the buzzword DeFi 2.0 is likely going to be “abused” by all DeFi projects, since “DeFi 2.0 = next-gen DeFi” could be applied to basically all, even existing DeFi protocols that keep innovating.

In case you wonder which projects get currently thrown into the bucket of DeFi 2.0, here is a non-exhaustive list (as you can quickly tell, the definition of DeFi 2.0 is somewhat vague):

While there is a lot of excitement around the new shiny DeFi 2.0 trend, there are also cautionary voices. It’s not without reason that “DeFi 1.0” blue chips like Compound, Aave, and co. have pursued a methodical building and growth process. With several DeFi 2.0 projects now shooting up like mushrooms, entirely new risks for the entire ecosystem emerge.

Are you still confused about DeFi 2.0 or want to dive deeper? Here is a good article by Cointelegraph that summarizes many important points.

But back to the main theme of this section: The fast emergence of DeFi 2.0 projects has proven again (just like the NFT trend did this summer), that picking up narratives early and adapting one’s investing behavior fast is critical for success in the crypto space.

With so much innovation happening in the fast-evolving L1, L2, and NFT ecosystems, being ahead of the herd can make the difference between astronomical rewards and high-risk FOMOing into already hot trends.

At the same time, not every crypto investor has the same time horizon and risk appetite. For some, a more long-term HODL-strategy can be more suitable despite lower returns and a less favorable risk to reward ratio in the short term.

The “Dog Flippening”

Is it the most important flippening in crypto land? 🤭 Not that we report very often on meme coins, but seeing Doge, the seemingly undisputed king in meme coin land, being challenged by “DOGE killer” Shiba Inu, is somewhat fascinating to witness.

SHIB is currently sitting in the 12th position on CoinGecko, only two spots (but a 2x in market cap) behind DOGE.

SHIB, which was created last year as a joke based just like Dogecoin, has seen its value rise meteorically this year. Last week, it gained over 350% in value.