November 3, 2021

Fear Is Creeping Back Into the Market – and That's a Good Thing

Introduction

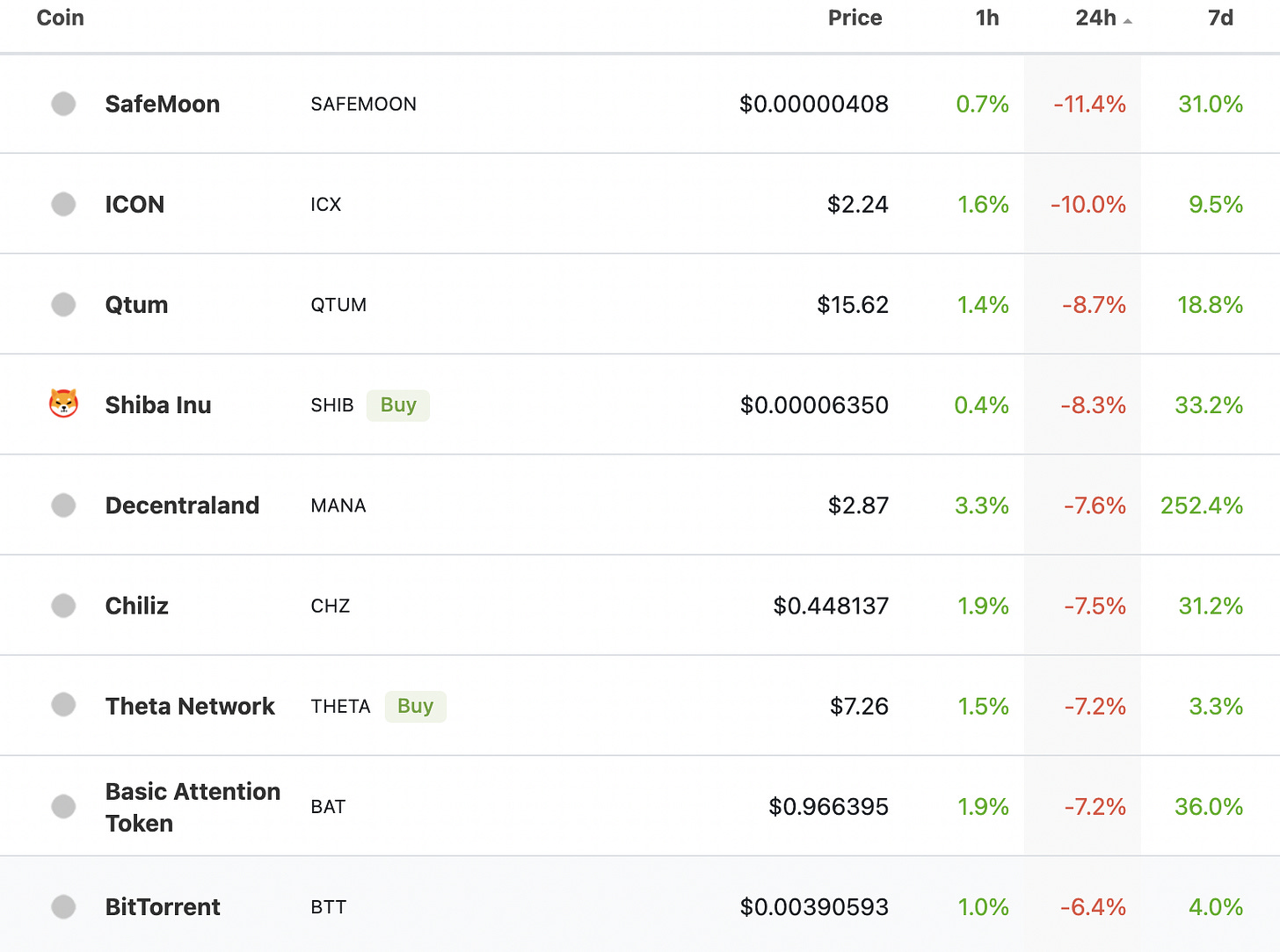

What a brutal day it has been: Bitcoin is down more than 2%, we see single-digit losers across the board and Ethereum… Wait, ETH is up slightly. Of course, we are kidding but it’s fascinating to see that even the smallest dips can lead to such a big amount of fear and “bear market calls” on Crypto Twitter.

If anything today has been a great reminder that this game of euphoria and fear which we call crypto investing will become more and more intense and volatile the more the bull market progress… Are you ready for this rollercoaster ride?

Some Thoughts on Investing Psychology and Taking Profits

Has the dip made today you nervous or did you even panic-sell some of your positions? Then you likely haven’t been around for a long time in crypto… While we know that nothing moves up or down in a straight line, it can be tempting to push the sell button when fear hits the market. While sitting in spot positions can be nerve-wracking at times, leverage trading only amplifies the emotional stress.

But is it really the time to be scared now with ETH consolidating on new highs and on-chain metrics indicating a “luke-warm” stage of the bull market? Probably not if you’re not overexposed and have gradually taken profits on the way up. In that case, you’re likely going to be able to stomach some more volatility going forward – which will inevitably increase the deeper we enter the mania phase of this bull market.

While the biggest gains come during the last parabolic phase of a bull cycle, it’s also the hardest time to hold on to your coins. So what can you do to not fall victim to emotional decision-making and sleepless nights? “DCA” is the key term.

The same way we built our positions during bearish times, the same way you can exit them. While everyone has to make his or her own strategies and risk assessments, an individually modified Dollar-cost-averaging strategy will take A LOT of burden off your shoulders.

When massive price pumps coincide with warning signs from an on-chain, sentiment, or leverage perspective, take profits. The more parabolic a coin goes, the more profits you should take. By increasing your sell sizes into strength you will, on the one hand, train your “take profit muscle” and on the other hand, you decrease your positions according to rising risk.

Of course, always align your buying and selling strategy with your fundamental thesis for holding a certain coin. This helps to zoom out and ignore some of the short-term volatility.

If you follow this strategy consistently and don’t make any stupid moves in the more volatile, latter part of the bull market, you will likely walk away as a happy camper. Don’t be like the herd and accumulate more and more altcoins the longer the bull market lasts…

The Best Trade and Possible Wrecking Ball of All Time?

Shiba Inu’s rise in the last few months has been spectacular to say the least. It made thousands of people and in particular one person extremely rich.

While some were speculating that the owner had lost access to his wallet, we were proven otherwise yesterday. If I were a SHIB holder, I’d be running for the hills…

Another Retrospective Airdrop

Have you claimed a .eth domain before yesterday? If yes, you’re eligible for the upcoming retrospective airdrop by ENS, congrats!

MetaMask Expanding Its Support for NFTs

It was about time for MetaMask, the number one Web 3 wallet by a long shot, to add more support for NFTs, which have emerged as a fundamental new part of the crypto ecosystem next to fungible tokens.

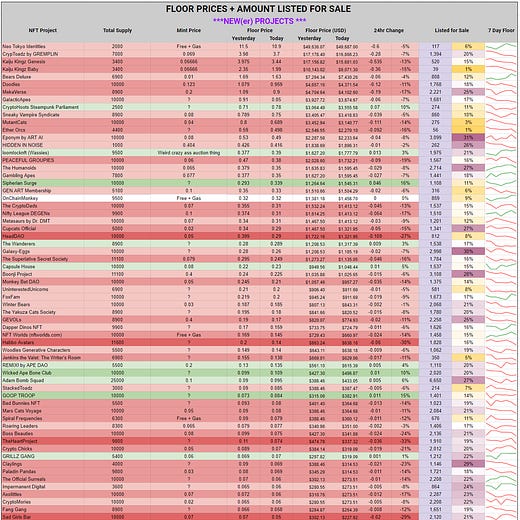

Is the NFT Bear Market Soon Over?

The last few weeks haven’t been easy for NFT holders: Floor prices have plummeted across the board and only a select few blue-chip projects could maintain their valuations. “Quick flip” opportunities have become a thing of the past… Is there an end to this trend insight? Here are some words of wisdom by NFT thought leader Zeneca33:

To end, here is some NFT hopium:

I'm curious to see how the influx of brands into the NFT world will affect the demand for non-branded colelctions.