November 17, 2021

There Are Still Plenty of Opportunities in Crypto Land

Introduction

With crypto prices continuing their decline today, uncertainty is lingering in the crypto community. It’s impressive how fast sentiment can change – it just needs a few days of corrective price action.

Instead of getting sucked into the overall bearishness of the markets, let’s instead focus on the opportunities which the crypto markets still present plentiful to the ones who are paying attention.

Bear Market Threads vs. Bullish Fractals

Where are the crypto markets headed next? Well, the opinions on that are torn. While some analysts are warning of a continued downtrend, others emphasize the likelihood of lengthening cycles and long-term growth potential.

We have already reported several times that according to historical data and on-chain metrics, this bull market should still have gas left in the tank. However, Bitcoin, Ethereum, and Co. are – according to most data science models – no longer undervalued in the short term, implying a higher risk as of right now.

No matter where you stand on the 4-year vs. lengthening cycle debate, in the short term, more downside is in the cards because many overheated indicators (on-chain, leverage, sentiment) have reset to some extent but have not yet reached common “reversal levels”.

Another L1 to Have on Your Radar

With Ethereum still struggling with high gas fees and scaling, alternative L1s have been one of the hottest narratives this year. Today, another contender called the attention to itself: Oasis.

Sitting at around a $300 million market cap, the ROSE token certainly has quite some upside potential if Oasis can pull off an “Avalanche- or Fantom-style move”. Monitoring project partnerships and TVL growth will be key going forward.

A Potential DeFi Gem…

DeFi protocols have had a rough last few months, with both blue-chips and smaller projects continuously bleeding. The few exceptions have been emerging DeFi protocols with a tiny market cap that experienced fast adoption (e.g. Visor Finance). Entering these projects early and riding their initial growth waves has proven to be a lucrative strategy.

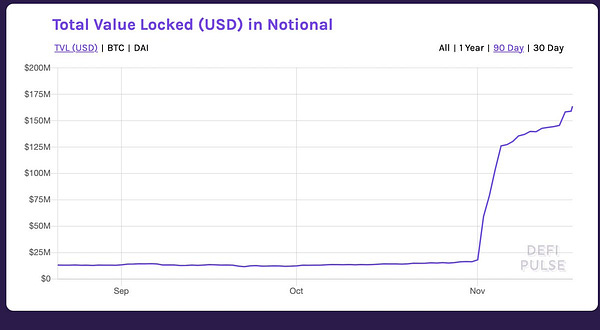

A potentially similar play could be Notional Finance with its NOTE token, sitting at just above a $10 million market cap as of this writing. Notional Finance aims to facilitate fixed-rate, fixed-term crypto-asset lending and borrowing, which has been a major missing piece in the current DeFi landscape. If their model works out, Notional FInance definitely has the potential to become a large DeFi protocol.

While you can buy NOTE on Uniswap (yes, gas fees are insanely high, unfortunately), the lower risk method would be to farm NOTE with stablecoins (you have to consider the high gas fees, however).

Remember that this type of play is risky since it is a very young project. Also consider that the circulating market cap of ROSE is very small right now, which will dilute NOTE holdings over time. On the bright side, a major part of the NOTE supply will not be released until Q4 2022 (you can read more on the project here).

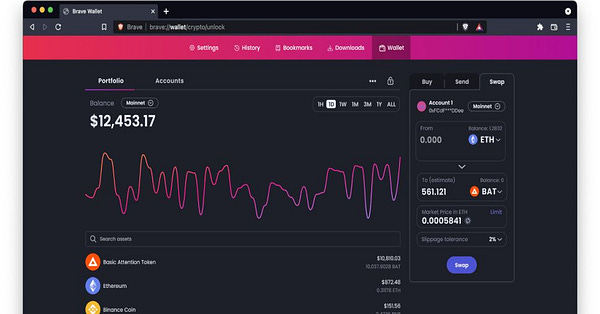

Web3 Is Moving Ahead… Fast

The news of the last few months has clearly shown that the Web3 narrative is not going anywhere but instead will continuously grow from here. Investment and innovation in the Web3 space are continuing at a relentless pace.

The Web3 and Metaverse narratives, while often overused buzzwords, will unquestionably be highly interlinked – hopefully avoiding a dystopian virtual reality world controlled by Facebook.

Light and Shadow on the Regulatory Front

Following the signing into law of the infrastructure bill with potentially devastating implications for the crypto industry in the US (and beyond), the fight for amendments to this catastrophic piece of legislation has started. Fortunately, it is no longer a purely partisan issue and change can still be achieved…

Meanwhile, the SEC continues on its quest to "protect consumers" and cement its anti-crypto stance. One can only hope that the SEC will increasingly isolate itself and face political pushback.

Ghosts from the Past – Apparently Harmless

Many crypto investors might not even know the story of one of the largest crypto hacks in history, which threatened the entire cryptocurrency space in 2014. Mt. Gox FUD has since spooked the crypto markets many times…

The Massive Crypto Sponsorships Continue

In the last few months, we have witnessed a veritable competition between FTX and Crypto.com when it comes to striking massive sports partnerships. The opinions differ on these insanely expensive deals, but they inevitably have one effect: they bring cryptocurrencies closer to millions of new people.

Another excellent issue of the important stuff! Much gratitude.

Amigo how do we reach you for our Metaverse project we worked 2 years to develop it. We have full whitepaper ready. ZlanderZ.net Have a look this is bigger than anything. Hurry up we can do this together and explain to you everything about our game before people openly copy our work .

Francis Labonté

Liliya Labonté

Linked in.

Regards,