Introduction

Well, yesterday’s price action was interesting, to say the least. After BTC and ETH rose to new highs after historically high inflation data was released, the crypto markets suddenly plunged… What happened and what’s next?

What the H** Happened Yesterday?

There are several reasons why the crypto market got slammed down pretty hard after the initial bullish move yesterday:

After the inflation data was released and Bitcoin started pumping, funding rates exploded across the board! Thousands of retail traders jumped onto the bullish news by opening up leveraged longs… Which obviously ended badly.

Just before the stock and crypto markets started crashing, Joe Biden announced that he aims to combat inflation and that he's interviewing possible successors to Jerome Powell as head of the Federal Reserve. This led to a panic reaction in the stock markets, spilling over into crypto.

In addition, rumors that Evergrande had defaulted, potentially crashing the global financial system, were spreading like wildfire – before being proven wrong later on. Evergrande managed to fulfill its debt repayments last-minute…

As a consequence, the dollar broke out massively, putting pressure on all risk assets, including Bitcoin.

So all in all, several factors came together that contributed to the fast sell-off: Some FUD in the financial markets coupled with high leverage in crypto

The question is: Where are we heading next? Right now, there are mostly positive catalysts within the crypto ecosystem (such as fundamental developments, growing adoption, and demand) standing against potentially negative factors in the broader financial markets (fear of Fed intervention, out-of-control inflation, Evergrande crisis, etc.). All of these factors together will determine price action going forward…

It’s definitely, quite a complex framework for investors that demands a lot of attention and potentially fast pivoting when things change… Let’s take it day by day with our eyes on the data! For now, things don’t look too bad.

Keep an Eye Out for Fast-Growing Protocols

During the late stage of a bull market, jumping into new projects with tiny market caps is a risky endeavor. What worked out amazingly well a year ago has now become a game of musical chairs. Most new projects will need years to show their full potential. That’s why projects like Aave, Thorchain or Fantom needed a full bear and bull cycle to reach their massive market caps. (Of course, there are a few notable exceptions like Daniele Sesta’s Spell which came out of nowhere and rose to a $2+ billion market cap in a few months… But spotting these is extremely hard.)

Now that the crypto markets are getting more saturated and market caps are much higher than a year ago, it is often the best strategy to bet on established but still relatively undervalued projects with room to grow. When identifying these, it is important to look at metrics that show that a protocol’s usage is growing which implies that a token’s price has room to catch up to its fundamentals.

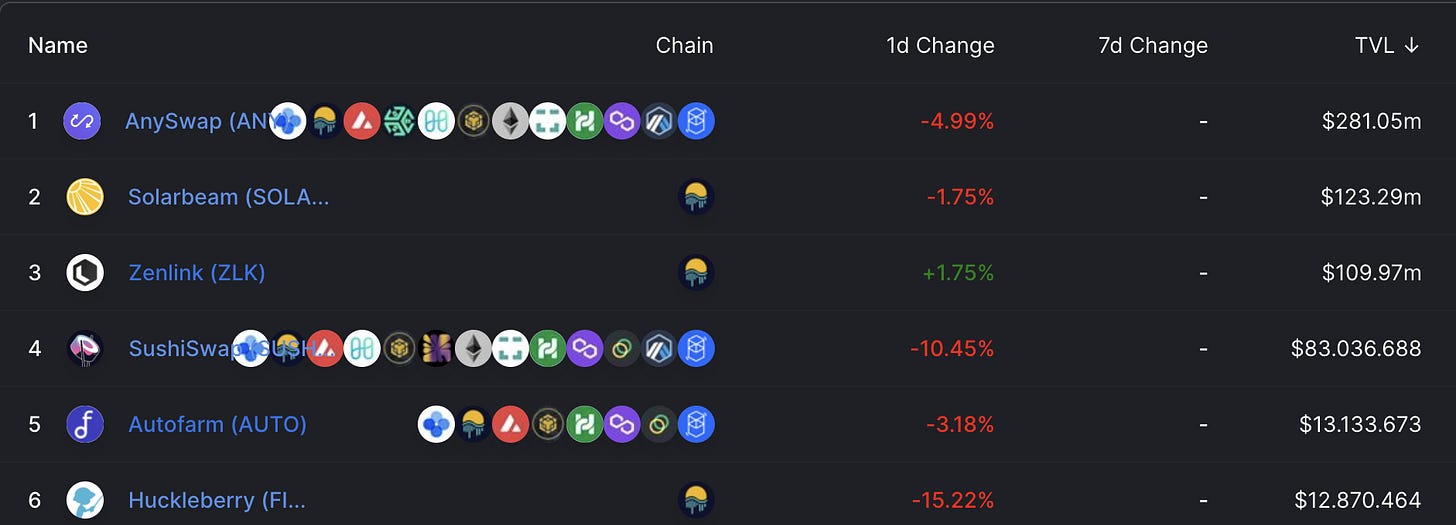

As an example, let’s look at Moonriver. The DeFi hub on Kusama has already flipped other L1s like Harmony when it comes to its TVL (Total Value Locked). If Moonriver catches a bid like other hot L1s (Solana, Fantom, Avalanche…) in recent months, MOVR might be a bargain at below $1 billion market cap right now… (Remember though that buying anything right now involves big risks.)

If you want to take on more risk and bet on emerging DEXes on Moonriver (aka, the “Uniswap or QuickSwap on Moonriver”), then keep an eye on Solarbeam (SOLAR) and Huckleberry (FINN). It might be risky to buy them now but it’s certainly worth monitoring their TVL to see if they gain any traction…

Another Airdrop Is Coming

Have you traded on QuickSwap or SushiSwap on the Polygon network before yesterday? If you’re a regular reader of this newsletter or watcher of the EllioTrades channel, probably yes. So, brace yourself for another juicy airdrop!

Hybrid liquidity DEX IDEX, which will launch its v3 on Polygon on the first of December, will reward Polygon users with IDEX tokens. To get the airdrop you will have to trade a minimum of $200 USD on IDEX v3 between December 1 and December 10 (similar to the dYdX airdrop a couple of weeks ago).

So, be sure to mark your calendars and follow IDEX on Twitter to not miss this airdrop!

Beeple on the Tonight Show

It’s crazy to see how far NFTs have come this year… While experimentation and speculation are ongoing in the NFT space, its bright future is written in the stars. Mainstream use cases and adoption keep growing and public recognition will rise with each new innovation brought by ingenious NFT creators.

Loving these newsletters Ellio thank you

It says in the post that buying anything right now involves big risks, is it because the market is overheated at the moment or because we are coming towards the end of cycle?