November 1, 2021

What Can Stop BTC and ETH from Price Discovery This Week?

Introduction

In the last few days, we have seen BTC and ETH consolidate while Metaverse projects and quite a few altcoins popped. What will the fresh week bring?

Without getting too ahead of ourselves, with a new all-time high monthly close, Bitcoin is looking very strong going into November. At the same time, ETH is on the cusp of breaking out while DOT is already in price discovery mode. Things could get interesting this week…

Market Watch

Of course, it shouldn’t come as a surprise that DOT, with crowdloans opening up this week, is breaking into price discovery mode today. DOT is probably the safest, fundamentals-based bet anyone could have made in the last few months with such a clear catalyst…

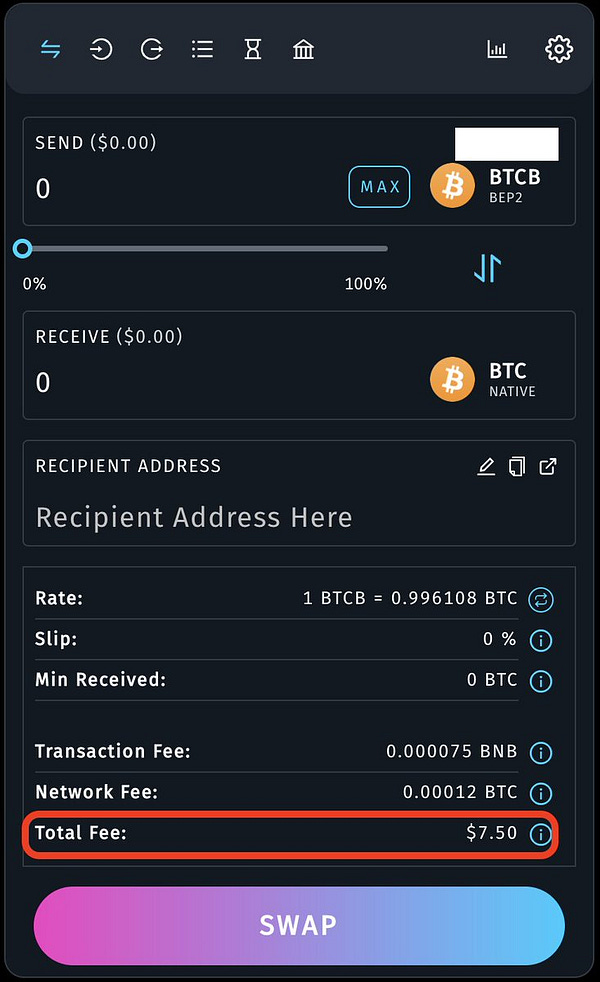

Another winner in the last days has been RUNE, up 22 % today and doing an impressive 2x in just seven days. We have stated numerous times in recent weeks that with Thorchain coming back online after its setbacks it would likely be one of the best performers in Q4.

ETH’s First Deflationary Week

In the last four days, Ethereum has been net-deflationary, meaning more ETH has been burnt than issued! What is certainly positive from a monetary perspective and shows the huge demand for valuable Ethereum block space, is the result of the continuous high gas fees last week.

The good news here is that ETH scaling, particularly roll-up solutions like Arbitrum and Immutable X, are making significant strides.

With ETH 2 inbound next year it’s no surprise that even the likes of Goldman Sachs are very bullish on ETH.

Avalanche Doubles Down on Its Incentive Strategy

The last three months have demonstrated impressively what good tech combined with a multi-million dollar incentive program can do to a L1 ecosystem: After its $180 million incentive fund had been announced, Avalanche’s TVL rose from $312 million to $2.6 billion in less than a month while AVAX’s market cap skyrocketed from under $2 billion to almost $17 billion!

Of course, the question arises what happens after these millions in incentives dry up… Well, the Avalanche foundation has just announced its fix: Another incentive fund, even bigger than the first one!

While this is of course good news for AVAX holders and yield farmers, the question about the long-term sustainability of this type of program is postponed into the future. Will the “snowball” of user and developer adoption be large enough to keep the momentum going? Or does it create the potential for a deeper drop in the future? We likely won’t know the answers before 2022 or even later down the line.

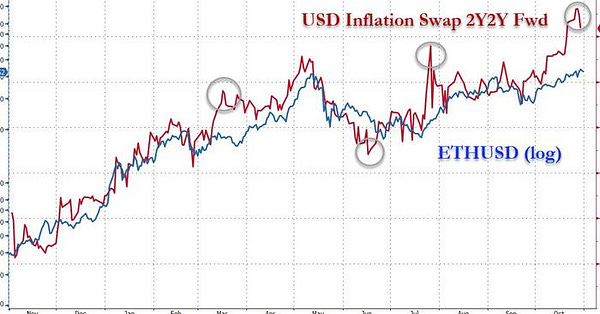

Why 4-Year Cycles Might Be a Thing of the Past

Crypto bull and bear market cycles have so far been clearly dictated by Bitcoin’s halvings – which made sense with the drastic impact that the halvings had on Bitcoin’s inflation rate.

Going forward, however, the impact of Bitcoin’s halvings will be much more subdued. Firstly because of Bitcoin’s decreasing market dominance and secondly because most of Bitcoin’s supply has already been mined. Thus, every additional halving of the inflation rate has a diminishing effect on supply and demand dynamics.

Willy Woo illustrates how these dynamics have already shifted:

Does this mean that we can throw the 4-year cycle theory out of the window right now? Probably not because market cycles are to a large extent influenced by psychology and market sentiment. With 4-year cycles being ingrained in many investors’ and traders’ minds, there is a case to be made that another 4-year cycle could play out as a self-fulfilling prophecy.

I guess we just have to remain open to different outcomes and keep our eyes on the data!

Stablecoin Report Out Today?

For quite some time the fears of a regulatory crackdown on stablecoins in the USD have been lingering. Today we expect to get news on how the US wants to approach stablecoin regulation, a very important matter for the whole crypto space.

While we don’t expect any sudden or radical blows, the report will be critical to determine how the crypto ecosystem and stablecoins will develop going forward – which certainly involves some fundamental structural changes.

Meanwhile, USDC issuer Circle and its CEO Jeremy Allaire don't seem to be too worried about the impending report.

Mainstream Resistance to Crypto is Crumbling

First they ignore you, then they laugh at you, then they fight you, then you win.

While on the edge of being overused, this quote (which actually originates from Nicholas Klein and not Gandhi) is arguably the best way to describe the path of crypto into the mainstream.

We have shown several stories lately that highlight the increased crypto adoption by banks and corporations. Today, The New York Times has published an eye-catching article on this trend.

Digital payments technology is forcing the financial system to evolve. Banks feel their power waning and want to regain control.

Not just banks, also many of the largest corporations in the world have shunned crypto until recently. Now we see the likes of Amazon and Google slowly but surely taking their first steps into crypto.

We also see more and more mainstream brands enter crypto in one or another way. Seeing McDonald’s and Burger King compete for crypto users is a thing of its own…

For the next three weeks, Burger King customers can enjoy a side of BTC, ETH or DOGE with their Whopper, thanks to a partnership with Robinhood.

The SQUID Rug

What we, unfortunately, had to expect with the advent of this massive meme coin season of the last few weeks, is materializing today: SQUID, a token based on the popular Korean Netflix series Squid Game has – what a surprise – turned out to be a scam, leaving thousands of people with a valueless token.

What do we learn from this meme coin saga? Investing in a random token without checking its fundamentals is extremely risky…

Unfortunately, stories like these don’t help at all to promote crypto to the mainstream. On the contrary, millions of people turn away from crypto after being victims of scams. In addition, the big headlines that such scams create also inevitably cause regulatory ripple effects…