Introduction

In today’s episode, we’ll dive deep into the realm of fortune-telling and tackle the question that is on everyone’s mind: When will this grueling bear market end that is bringing so much financial destruction and negativity among the crypto community? Of course, no one knows with certainty, hence the reference to fortune-telling. However, since our channel tries to formulate theses and frameworks on the basis of facts and deep research, we’ll do our best to dig up the most relevant data out there. Let’s jump in!

Where We Are Today

There is no question that we find ourselves in the middle of a bear market. While we and many other analysts didn’t expect the imminent start of such a vicious bear market towards the end of 2021, in retrospect it was the right call to aggressively take profits and “get some bacon for winter”. After all, winter is exactly what we got – faster and colder than expected. Bull market euphoria quickly turned into bear market pain…

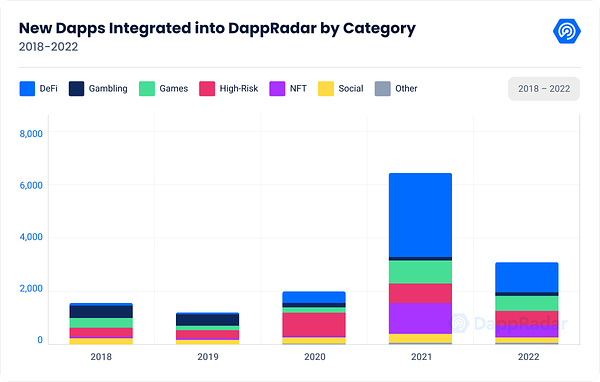

As we pointed out in other episodes, while prices reached new all-time highs last autumn, from an on-chain distribution perspective, this current bear market arguably already started last April/May! What we witnessed in the following months, is the recycling of existing capital within crypto: From one L1 ecosystem to another, then the Metaverse narrative heated up, and finally capital cycled back to NFTs once all the juice seemed squeezed out from altcoins in early 2022.

This money cycling behavior is typical for the transition from a bull to a bear market and we also witnessed it in a major way during the ICO craze of 2018.

Looking at prices, we can see that they have come down significantly across the board. While last year’s “hot” L1s like Cardano, Fantom and Solana have all corrected between 80 and 90 %, many small caps got absolutely eviscerated with some being down over 99%. The only coins holding up better – as we would expect them to do during a bear market – are Bitcoin and Ethereum, down 57 % and 63 % respectively.

It’s clear: You don’t wanna hold risky altcoins during a bear market and even if a coin is down 80 %, there is a high probability that it will crash another 50-90 %.

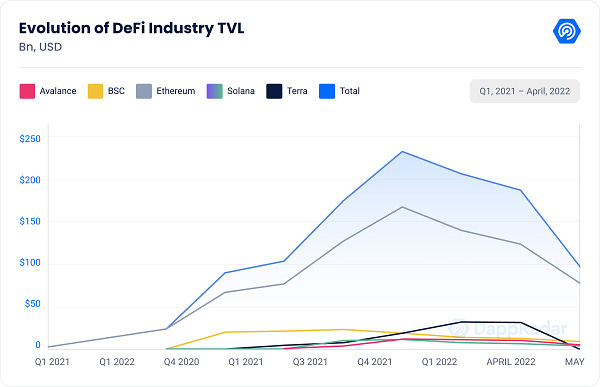

Of course, we also have to mention that this bear market already took a big toll on DeFi and “non bear market proof” Ponzi schemes like the Terra ecosystem which has sadly collapsed and hurt many people badly.

You can see that the TVL in DeFi has halved from over $200 to just $100 billion in a few weeks… Is DeFi dead? We will tackle this question in a separate article.

The Recent Decoupling From Stocks

Now that we have assessed the damage already done to crypto prices and the overall ecosystem, let’s get to the important question: How long will this pain last? Because after all, retrospect is interesting but we can only act in the present moment. As our friend Darius put it: It’s all about the Next Play!

In order to leave this grueling bear market behind us, there are two ways: Either crypto and legacy financial markets bottom at the same time and resume their multi-decade uptrend. Or, crypto decouples from equities.

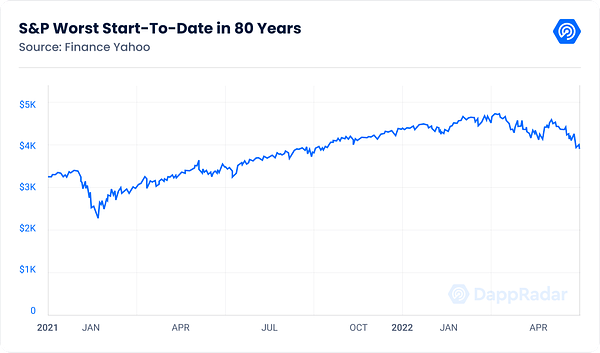

While we all hope for the latter to happen, the last few days have shown signs of a decoupling we certainly didn’t hope for. Despite crypto generally performing better than stocks during the downturn of recent months, the last few days have shown an unfortunate trend change: Crypto has been showing significant relative weakness.

At this point, we can only hope that this decoupling of recent days is only a blip and that crypto can catch up with stocks that are generally bouncing as of late.

However, in the long term, every seasoned crypto investor is hoping for crypto to regain its status as an uncorrelated asset class that’s not manipulated by legacy actors (or do we just want “number to go up” regardless of what stocks do?...) In order to form a thesis if, when and how crypto might decouple from stocks in the long run, we have to talk about the elephant in the room:

The Fed – the New Boogeyman

There is no question: You could look at adoption and on-chain metrics all-day long but if you hadn’t anticipated the massive impact the Fed’s policy U-turn would have on financial markets (and yes that includes crypto) then you were likely blindsided by the last months of bearish price action. In retrospect things seem pretty obvious: Once the Fed signaled that they would turn the “money printer” off last November, things were starting to look dire for risk assets.

Of course, all of this was caused by the highest inflation the Western world has seen in many decades – which in turn was caused by massive money printing as well as supply shocks. It’s only because of high and persisting inflation numbers that central banks had to stop their easy money policy and start fighting the new enemy number one.

On the flip side, the million-dollar question now is: When will the Fed U-turn again? Getting this answer right likely equates to the biggest play you can make as an investor in the coming years…

In the short term, there are no signs that a Fed U-turn is in sight: Inflation is still near its highs and the economy is not slowing enough to signal the Fed to stop tightening (yet). So the question remains: What is already priced in and how much pain do we have to expect?

While the “risk” of a bear market rally is always there, especially after non-stop selling and fear as we have witnessed in recent weeks, it’s important to not miss the bigger picture – which in the mid-term doesn’t signal that the pain is over.

In fact, the effects of Quantitative Tightening by the Fed which starts on June 1, haven’t even kicked in yet…

So, what would signal to us that a Fed reversal and with it the bottom of this bear market is near? There are two different scenarios:

Either inflation comes down so quickly back towards 2 % that the Fed can naturally stop tightening. This is VERY unlikely and most forecasts suggest that inflation – while peaking – will remain well above 3-4% into 2023. So, no signal from inflation for the Fed to stop anytime soon.

The more probable scenario is that while the Fed keeps tightening in the weeks and months to come, financial conditions will continue to deteriorate, raising the risk of a severe recession or something “blowing up”. In fact, we have already seen credit spreads (a sign of the inherent risk within the financial system & economy) widen substantially in recent weeks. If something in the credit market or economy “breaks” (just like it did in 2020), then the Fed would likely have to stop what they are doing. So, it all comes down to monitoring financial conditions and the communication by the Fed this summer…

As Darius Dale puts it: “It is likely we are only in the middle innings of the bear market in high beta risk assets. With the Fed unlikely to receive any signals from either the labor market or inflation statistics to stop tightening monetary policy for at least another quarter (perhaps 2-3), it is likely financial conditions must tighten considerably to force a dovish pivot.”

Fed Tightening Is Not “the Last Shoe to Drop”

An important point to remember is that the Fed is not the only boogeyman spooking asset markets right now. In fact, the Fed only induced this crisis. However, after liquidity dwindles, serious problems can arise for the economy and company earnings. In simplified terms:

The Fed removes money from the system -> financial conditions tighten -> people can afford less spending –> the economy slows down –> company earnings shrink -> asset markets tank

While we have witnessed quite some pain in recent months, we haven’t priced in these recessionary earnings dynamics yet… Macro analyst Darius Dale explains it well in this Tweet:

The current bounce in markets is clearly signaling that the Fed-induced negative “liquidity cycle” is nearing its final stages. However, brace for more damage in financial markets once data shows our economy is on the brink of recession. Q2 earnings season could get… interesting.

Some Thoughts on “Timing the Bottom”

Timing cycles is extremely hard. Especially once strong trending phases like we have seen during the first months of this year are over and markets enter a more prolonged sideways range, it’s hard to get a clear picture of the markets. Key points here are surviving and staying patient. Bear markets don’t entail prices crashing non-stop. They can also go sideways, grind up and down for an extended period.

What makes this market downturn different from many others, the March 2020 crash, for example, is that we have no clear event signaling the start and end of the price crash. While we got the pandemic and then massive easing by central banks in 2020, we now find ourselves in a more structural bear market, with liquidity and growth hindering price growth. While inflation remains elevated, there is no clear “switch” that will signal a V-bottom reversal. Instead, we will probably go through a prolonged phase of prices grinding lower and higher with some vicious crashes and hope rallies sprinkled in.

Comparing This Bear Market to the Last One

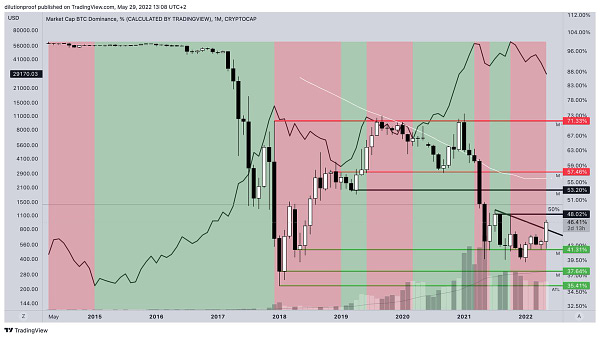

This bear market has shown once again that “history doesn’t repeat but it rhymes”. In fact, we have followed the typical 4-year cycles once again.

Is the Bitcoin 4-year halving cycle still a thing or are macro factors overriding this once almost religiously significant price catalyst? From today’s standpoint it’s hard tell because of the complexity and interplay of factors. Supply and demand are driven by different forces (e.g. miner emissions vs. Fed liquidity). However, it’s a fact: So far, the 4-year cycles have still held up… According to the 4-year cycles, we could expect the bottom of this bear market to occur sometime late this year. This magically coincides with the “macro turnaround“ as estimated by Darius Dale.

There are two big differences between this bear market to previous ones:

1. There was no “blow-off top” signaling the top of the bull market (speaking for the increased efficiency and maturation of the crypto market).

2 The percentage returns of the last bull market were significantly lower than during the last cycles, deviating strongly from most expert estimates and data science models.

The conclusion? The market always finds a way to surprise the maximum number of people… There is no free lunch in investing!

To end this article, let’s look at some interesting comparisons between the current and the last cycle: