December 6, 2021

Is This Only a Correction or the Beginning of the Bear Market?

Introduction

Fed tapering, Evergrande default, Omicron… For weeks, we have been warning that significant macroeconomic headwinds were starting to blow, threatening to crash the stock and crypto party (at least temporarily).

With the amount of leverage and froth across all asset markets, the threat of a significant liquidation-induced sell-off was rising by the day – and that’s precisely what we got last Friday in both the stock and crypto markets.

Is the worst over for now, or should we expect more downside? That, of course, is the big question hanging in the air.

By the way: If you wish you could have gotten updates on the unfolding market meltdown this weekend, go ahead and follow Elliot, Daton or me to get news and real-time perspectives from the team.

Market Watch

It’s clear that opening up Blockfolio to check one’s portfolio hasn’t been pleasant for crypto investors in the last few days – unless you were prepared for the crash and are now looking forward to new opportunities.

In the last days and weeks, crypto prices have been rising and falling in lock-step with the stock markets: Sharp declines, bounces, and further downside – almost everything happened in tandem.

We can in fact go back and compare the price action of Bitcoin and the S&P 500: They have been strongly correlated for months now… Hence, even though we don’t like it, crypto investors are HIGHLY dependant on what is going on in the macro world.

As you can see in the chart above, the S&P 500 (and Bitcoin) is sitting on top of important support levels on the daily time frame right now. So, the chance for a bounce this week is relatively high – the question is: What comes after?

With the lingering fear catalysts in macro land, especially surrounding the Fed’s next decisions, it’s certainly advisable to keep your risk management in check. If the Fed really sticks to its faster tapering pace, then yes, we could be in for a bloody end of the year.

At the same time, extreme fear like we see currently often marks the best buying opportunities in hindsight. Since we can’t perfectly predict price action going forward, a “DCA approach” seems appropriate, especially given the uncertain climate. That means: Buying slowly on dips and accelerating buys with increased panic in the market – precisely the opposite of the profit-taking we did on the way up…

Have We Entered a Bear Market?

Of course, the question on everybody’s minds is: Are we only experiencing another bull market correction, or is this the start of the decline into a brutal bear market? What helps to answer this question (apart from technical analysis, which at this point indicates that we still could be in a bullish macro structure), is a look at both macro and crypto-internal metrics:

When it comes to the macro picture, we have already outlined that uncertainty is high, and what we see in the stock markets at the moment could mark the beginning of a multi-month bearish trend – with a strong spillover effect into crypto.

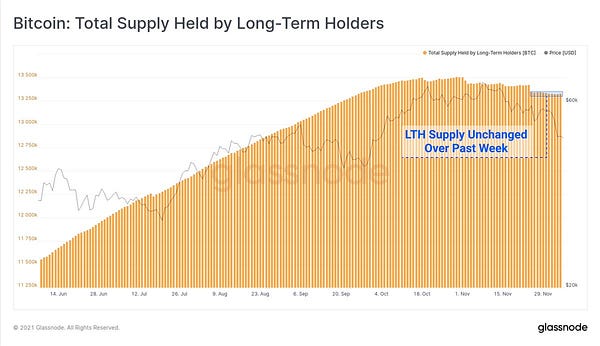

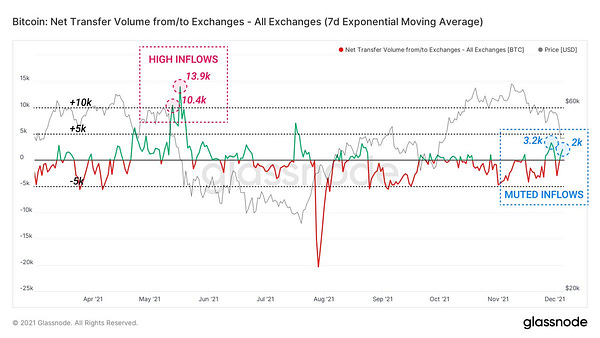

However, when we look at on-chain metrics, we haven’t yet seen the typical signs that mark the beginning of a full-fledged bear market – specifically, whales and long-term holders starting to sell en masse, which would mean game over for the crypto bull cycle.

However, looking at on-chain metrics after last Saturday’s crash, we can see that long-term holders haven’t been fazed much, and almost exclusively short-term holders have panic-sold. This is generally behavior we would expect in a bull market correction and not a bear market.

To sum it up: At this point, not much indicates that we have entered a crypto bear market. The fact that certain subsectors within crypto are showing strength vs. Bitcoin could be a sign that the market is not ready for full-on bear mode yet.

However, the risk of a dark winter is certainly there, given the uncertainty in the macro environment. We have to keep our eyes peeled, especially on the Fed’s actions!

Getting Your Hands Dirty With ZK-Rollups

While we know that ZK-Rollups will likely be the future of Ethereum (and the overall crypto space), there are not many ways to bet on this emerging trend yet. Yes, you can invest in DYDX or IMX, both ZK-Rollup-powered projects built on StarkEx.

But what we are really looking for is a chance to invest in the first fully-fledged EVM-compatible ZK-Rollups, on which the next generation of DeFi and NFT protocols will be built. Since these aren’t live yet / have a token, we must be attentive to spot potential airdrops or projects launching on StarkNet & ZkSync early (e.g., the “Uniswap on StarkNet”).

Odin-free.eth has done a great job summarizing everything currently going in the ZK-Rollup space and how you can “farm” potential airdrops (these are just a few Tweets of his thread, feel free to check the whole thread here):

Will NFTs Have a Comeback Soon?

With crypto prices likely to consolidate in the weeks to come, the question arises: Will NFTs start to blossom again, just like they did this summer when ETH and Co. entered a “mini bear market”? The possibility is certainly there, and Google search volume suggests that the mainstream interest in NFTs is still growing…

NFT search volumes continue to rise every single week... highly effective retail onboarding mechanism that hasn't yet peaked, one of the only charts still at ATH's

NFT search volumes continue to rise every single week... highly effective retail onboarding mechanism that hasn't yet peaked, one of the only charts still at ATH's Continue to revisit/follow NFT trading volumes and NFT search data Search volumes continue to rip higher. NFT volumes started coming back last wk or so... theory is that people onboarding, just doing so slowly b/c UX/UI isnt great https://t.co/kAGZySbnq9 https://t.co/AilzKeSqSz

Continue to revisit/follow NFT trading volumes and NFT search data Search volumes continue to rip higher. NFT volumes started coming back last wk or so... theory is that people onboarding, just doing so slowly b/c UX/UI isnt great https://t.co/kAGZySbnq9 https://t.co/AilzKeSqSz Sisyphus @0xSisyphus

Sisyphus @0xSisyphusDoes that mean that all the PFPs we have seen shooting up like mushrooms this summer will come roaring back? Absolutely not since there is clearly a massive oversupply of low-quality NFT collections and "cash grabs" out there that, in all likelihood, will trend towards 0. But NFT projects with strong utility and communities might get a chance to shine again.

Thanks Oliver appreciate the post, have a great day!

Thanks guys.. another great read!