Introduction

Is it tax-loss harvesting that caused the crypto market sell-off at the beginning of the last week of 2021? Or is it just whales playing with super-thin order books in a week where institutional investors are mostly absent? We can’t tell for sure, but one thing is clear: Last week’s price gains and the euphoria on Crypto Twitter have evaporated faster than they came.

Market Watch

After a few rather brutal weeks in the markets, the eagerly awaited Santa rally came after all last week. However, the fun didn’t last long, and Bitcoin’s short-term ascent got stopped precisely at the critical resistance level everyone was watching: $53k.

What does that mean for the markets? Well, most likely more of what we have seen in November and December: consolidation. Crypto prices showing this much weakness and panic at first sight of overhead resistance is certainly not a good sign in the short term… However, we should also not overinterpret today’s dump, given the low volume in this holiday week.

A bit concerning is that crypto, while correlating strongly with equity markets, underperformed them massively in recent weeks. While only benefitting mildly on moves to the upside, any shakiness in stocks has led to an abrupt sell-off in the crypto markets.

On a more positive note, even though crypto has underperformed equity markets recently, the signs for a continued overall risk asset rally in January are mounting.

What do we need to change the current negative trend in crypto markets? Well, either crypto fundamentals improve strongly for price action to follow – however, we don’t have as many catalysts lined up right now. (“Maybe” the Merge in a couple of weeks?). From an on-chain and structural perspective, it’s indeed not a very bright outlook at the moment.

Another possible driver to change the trend back in favor of the bulls could be a structural change in buying and selling activity. While it’s unlikely that retail investors will flood into crypto out of nowhere any time soon, institutional investors may start redeploying capital in January. That’s the biggest hopium we have right now.

With macro conditions likely going to deteriorate and not improve over the course of 2022, it’s likely that January (maybe also February) is the month that determines if we can get another rally in this bull market cycle. Later in the year, the signs point to a storm with a choppy grind up in the best and further drawdowns in the worst case. (This refers to the general market, but of course, there can always be exceptions of fundamentally strong projects with fast-growing adoption.)

Some fractal hopium is never wrong, though:

It’s Airdrop Season Again

In 2020 Uniswap introduced an entirely new form of token distribution at scale: the retrospective airdrop. Soon after that, many existing and new DeFi protocols executed their own airdrops – some more, some less successful. Once it became harder and harder for projects to perform a “good airdrop,” the trend slowed down somewhat.

Recently, however, airdrops have made a comeback. Especially the ENS airdrop went to become one of the most successful token distributions ever.

This week the crypto community was treated to two more airdrops: SOS and GAS (go claim them if you haven’t already).

However, it would be unfair towards ENS to throw SOS and GAS into the same category since both of them don’t have a working product (yet), and there are several red flags…

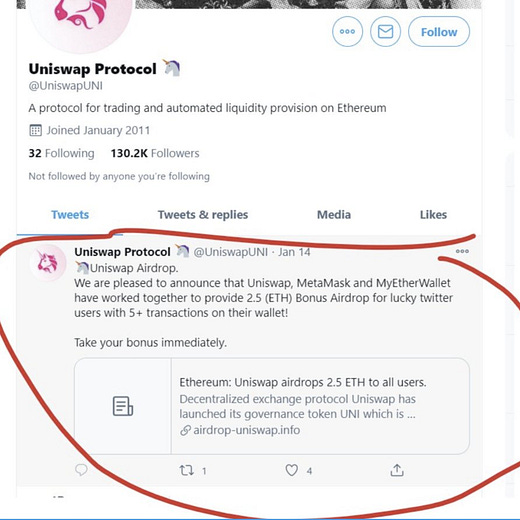

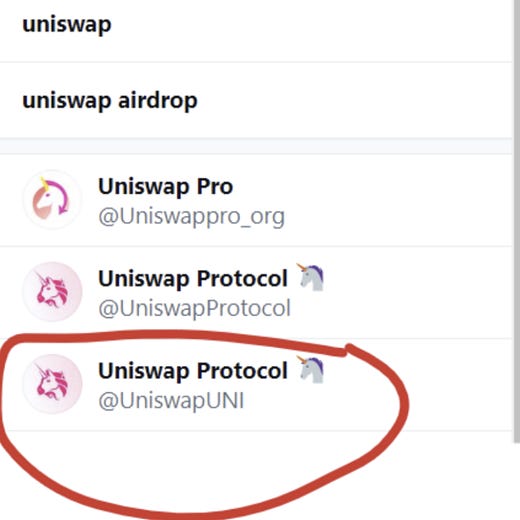

While getting rewarded with free money for using crypto protocols is nice, it’s important to differentiate between the different airdrops. I’m not saying SOS and GAS are scams (even though we haven’t gotten many details about the two projects yet). But this new wave of airdrops of new projects opens the door for shady actors…

Real Worlds Assets Coming to Aave

When you asked crypto people a few years ago about upcoming use cases, tokenizing real world assets was one of the most mentioned. However, due to a lot of friction and legal complexities inherent at the intersection of the digital and physical world, it has taken much longer for RWA tokenization to take hold.

While we have already seen isolated projects of real world asset tokenization, these were mostly executed in a permissioned manner (e.g., the tokenization of real estate or wine by a few companies). Bringing real world assets into the global world of DeFi would undoubtedly be a milestone for the crypto space – and that’s exactly what Aave is shooting for!

At this point, it’s hard to tell if this specific product by Aave will catch on in the short term. But there is no doubt that in a couple of years, real world assets will be a central part of DeFi, just as altcoins and stablecoins are today. The projects that can capitalize on this massive trend will likely experience tremendous growth.

The RWA Market is a much-needed building block not only for protocols such as Aave, but across DeFi as a whole," said Stani Kulechov, found and CEO of Aave. "Knocking down barriers of entry and making DeFi accessible to all is part of the Aave Companies' vision, and we are excited to be fulfilling this through the collateralization of real-world assets, made possible by Centrifuge.

On top of Aave’s real world asset integration, there has been another announcement hot off the press which will excite L2 fans!