Introduction

If you made it through this weekend well and alive, congrats, you survived one of the most brutal crashes in crypto history! Yes, we know crypto can be volatile and that 20% down or updays are nothing out of the ordinary. However, after 11 red weekly candles out of the last 12, probably not many – even the biggest bears – would have expected the vicious price action we witnessed in the past days.

When Bitcoin broke its 2017 highs of 20k decisively and crashed down to the mid-17ks, probably quite a few crypto holders had a sinking feeling in their stomachs. While BTC bounced back yesterday, we still find ourselves struggling with the infamous 20k level today… Will it hold or not? What has caused this massive crypto crash, and what does it mean for the outlook of this asset class? Let’s dive in.

What This Bear Market Has Taught Us So Far

The more and more 2022 progresses, the more we had to learn a few (unfortunate) facts:

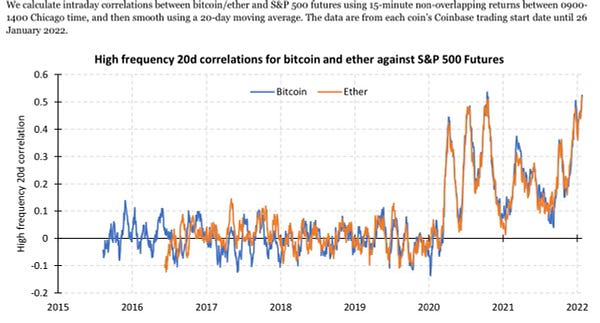

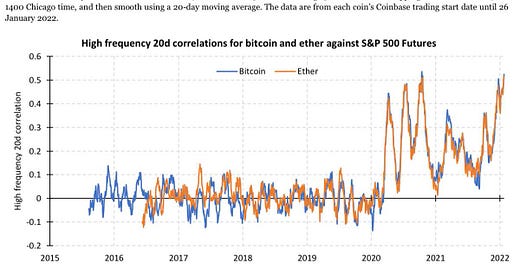

Crypto has in no way been uncorrelated from stocks and other risk assets. In fact, crypto has had a record-high correlation with stocks during this market downturn (see chart below). Crypto has practically performed like leveraged tech stocks.

What is coupling and decoupling mean in crypto? Correlation of Bitcoin and Ether to Equities through time.

What is coupling and decoupling mean in crypto? Correlation of Bitcoin and Ether to Equities through time.

Bitcoin has failed to act as an inflation hedge, and with an over 70 % price decline, its “store of value” and “digital gold” narrative has taken a serious blow.

While crypto has been hit hard, it doesn’t have to take all the blame: Equities – especially tech stocks – had to take an equally large haircut, pointing to the fact that we are witnessing a powerful risk-off period that affects all risk asset. In 2022 so far, cash has been king!

I cannot emphasize how true this is. Congrats on surviving a crypto crash, but that's a whole different beast from "the whole system is falling apart and capitalism might be coming to an end." Those are a different kind of scars.If you had no assets in 2008 please don’t sell me your gained experience off the crypto crash of 2017

I cannot emphasize how true this is. Congrats on surviving a crypto crash, but that's a whole different beast from "the whole system is falling apart and capitalism might be coming to an end." Those are a different kind of scars.If you had no assets in 2008 please don’t sell me your gained experience off the crypto crash of 2017 Jake - The Logical Jawn in Philly @Versuhtyle

Jake - The Logical Jawn in Philly @Versuhtyle

A House of Cards – Built on Greed and Leverage

Now, let’s address a key question that probably occupies the minds of many crypto holders: What has caused this vicious crash we had to endure? There are a few explanations:

We find ourselves in the middle of a historic macro storm that has sent all risk assets crashing down. With crypto being a nascent asset class that never had to go through a major global recession or financial crisis (except for the Covid flash crash which was short-lived and quickly resolved with massive money printing) it’s no surprise that crypto is deflating so much when the S&P 500 is down 20% and the NASDAQ over 30%... We will look again at the macro outlook later in this article.

Negative GDP growth, bear market, inflation, 130% debt to GDP and rate hikes. None of us have ever witnessed this.

Negative GDP growth, bear market, inflation, 130% debt to GDP and rate hikes. None of us have ever witnessed this.The second big reason why we are witnessing such coordinated selling is the massive institutionalization of crypto. While everyone was cheering for institutional crypto adoption in 2020, the large influx of traditional investors now comes back to roost because with crypto being perceived as the riskiest asset class, BTC, ETH, and co are the first assets to be liquidated from institutional books. Stocks crash 10 %? Now funds have to sell other assets to cover margin calls and reduce portfolio risk. This self-perpetuating mechanism has led to the relentless selling in recent weeks.

Now onto the big culprit for the massive price declines (not only but especially impactful in crypto): Leverage and bad risk management. Without the massive build-up of leverage through the bull market, we would likely have seen more gradual price declines. While this time, it’s not only leveraged traders on Bybit and other leveraged exchanges who caused the crash (they already got wiped out at higher levels), we witnessed massive liquidations from VCs and crypto funds. The blow-up of 3 Arrows Capital has impressively demonstrated what horrific consequences over conviction and a lack of risk management can have on the crypto market. And when it strikes such a large and systemically important player like 3AC, the ripple effects are felt throughout the whole crypto ecosystem…

In the Short-Term: Has Enough Damage Been Done?

Assessing the damage is one thing but since we can’t change the past, let’s now look at what the future may hold. After all, it’s times like these that are ripe with risks and opportunities and the decisions you are taking now could likely shape your financial future!

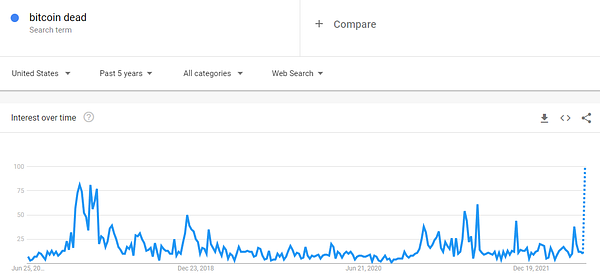

After the last days’ brutal price action one has to think that enough damage has been done and that we are in for some form of relief bounce – especially given the massively negative funding fees on exchanges (see below). After all, we witnessed some of the purest forms of capitulation and forced selling. At the same time, sentiment is hovering at record-low levels. Of course, we can’t take past price action and sentiment as a guarantee for what’s coming next but a bounce is certainly a “risk” everyone should have in their short-term playbook.

Another reason why we could see a bounce in the near future is that equities find themselves at record oversold levels after last week’s selloff. This doesn’t mean that we can’t see further red days if bad news comes out (of which we expect quite a bit in the weeks ahead) but that the natural direction for price in the short term might be up.

What could lead to further downside in the short term? Well, either it’s a continued stock market crash and/or further forced selling and ripple effects caused by the blow-up of 3AC and possibly other actors we don’t know of yet. Forced selling from insolvent funds can take time with “bodies floating to the surface” weeks after the initial dominoes fell.

The Mid-Term Outlook Remains Difficult

There is a small probability that the massive liquidations and blow-ups of the last days have forced prices so low that we won't see lower lows anytime soon. However, that doesn’t mean that the bear market grind will end shortly. The last weeks’ price drops and scandals in crypto land have shattered a LOT of confidence which will take a long time to rebuild it.

While in the short-term (meaning from a few days to several weeks) we could expect some mean reversion of prices to the upside, the fact is that nothing has changed the bigger macro picture: Inflation is expected to remain at record high levels throughout the summer which means that central banks will remain engaged in monetary tightening. QT and massively tighter financial conditions will bring the economy down to its knees and with it risk assets (which can bottom earlier though). While a lot of fear has certainly been priced in in the short term, this doesn’t mean ALL adverse news can be anticipated by markets.

According to macro analyst Darius Dale (who has nailed this bear market so far with his predictions), the next big shoe to drop could be an earnings recession which will likely be priced in by markets in July and August (Q2 earnings season starts in 2-3 weeks).

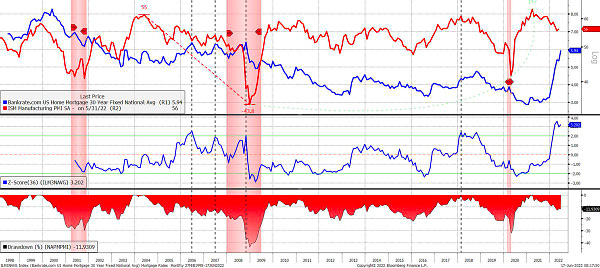

While bad earnings are very bad for stock markets, there are more storm clouds brewing that will affect all markets. With mortgage rates having risen incredibly fast in the past few months and the middle class being “squeezed” by record-high inflation, a real estate crisis is in the making. With real estate being even more important than stocks when it comes to the “wealth effect”, a deflation of the housing bubble could have severe consequences for the whole economy and risk appetite of investors.

Will crypto be able to bottom while the real economy and asset markets continue to tank? While there is a slim probability that institutional capital will be “washed out” and crypto can become an uncorrelated asset class of “diamond-handed hodlers” again, the chances for people plowing money into crypto during a global recession are extremely low.

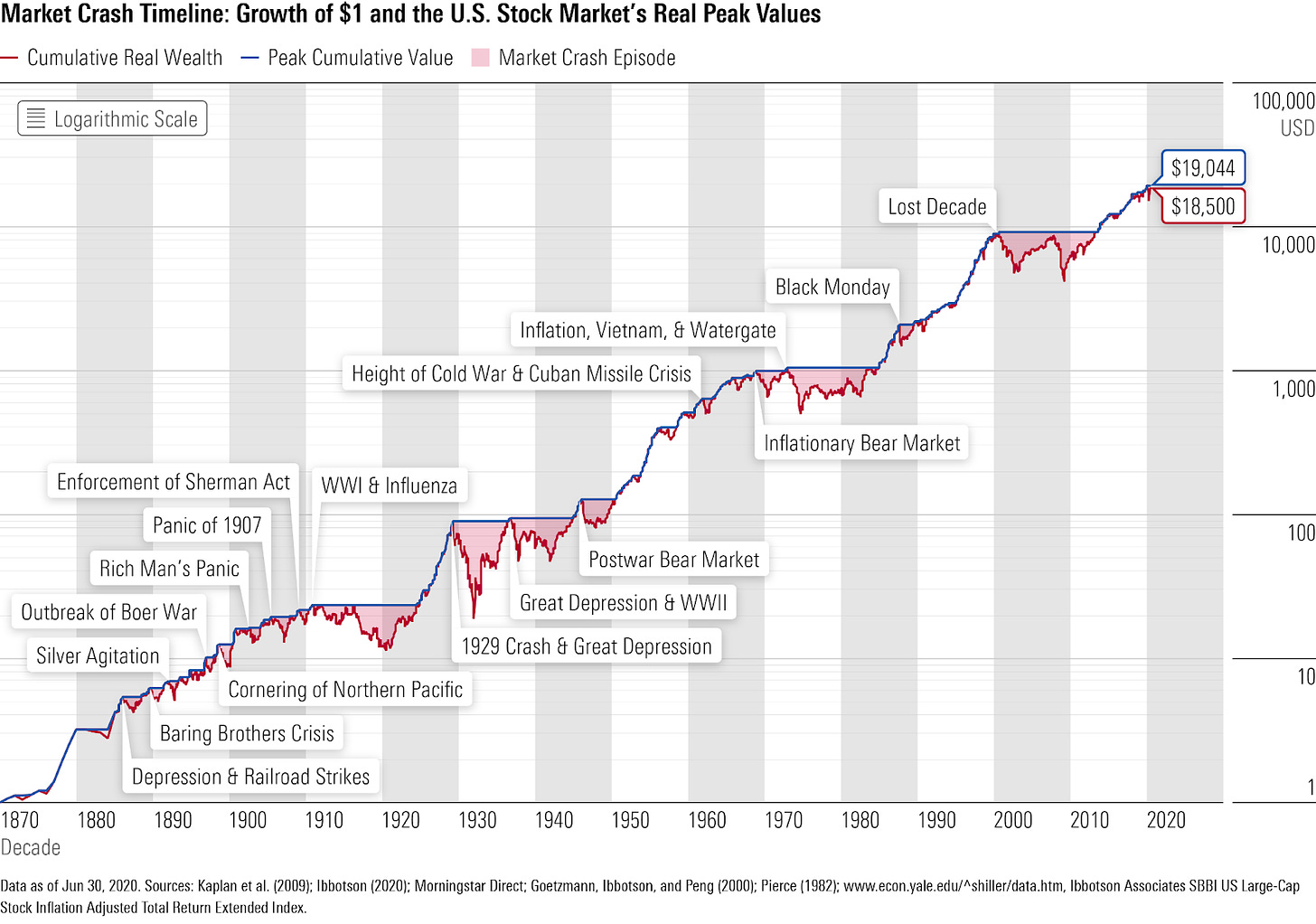

While we find ourselves in an unprecedented environment, comparing this year’s price action with the bust of the dot-com bubble in 2000, we see some interesting similarities. If this past fractal holds true we could be in the late stages of the bear market today (not at the lows though). Don’t let a potential short-term bounce make you believe the next bull market has started!

Long-Term: Nothing Has Changed

After chewing through the grim past and mid-term future, let’s now focus on the more positive perspective. After all, the long-term outlook for crypto is still bright as ever with the past months clearly demonstrating the flaws of today’s financial system. Global central banks have created a “casino” that forces everyday people to gamble away their income and retirement savings. In the current environment, average people can only lose: Saving cash in your bank account? You got screwed by inflation. Being fully invested? You just took a 20+% hit to your net worth… The need for an alternative system has never been bigger!

While crypto prices haven’t been spared from the Fed’s manipulative force (by first printing and now removing liquidity), crypto’s original vision clearly represents the best way out of this nightmare. In the past decade, the crypto community has come together to build a new financial system that offers a way to opt-out of the madness of traditional finance.

Yes, crypto still has many flaws and both greed and the influence of legacy finance have made the space deviate from its original path. But the current crisis is nothing less than a wake-up call to get back to the roots and focus on the original vision that Satoshi Nakamoto had in mind when creating Bitcoin: To free people from the overreach and manipulation of governments and central banks and create a more equal, free financial system.

What Should You Do Now?

What we wrote in our 2022 outlook has (unfortunately) proven right: This would be a year where capital preservation is more important than aiming for for big gains. While no one can trade perfectly around market cycles and time bottoms and tops, the drastically shifting market environment has forced every crypto investor and trader to rethink his or her strategy.

In a structural bear market as we find ourselves in today, “selling rips” and buying big red candles is the way to go. This means every bounce should be regarded as an opportunity to assess one’s holdings and possibly derisk. While cash is king in such an environment, this doesn’t mean that you shouldn't take advantage of attractive prices offered by crashes as we witnessed on Saturday. If you still believe in the long-term prospects of crypto, then such massive price drops should be viewed as a unique buying opportunity to either add to your long-term “hodl” stack and lower your cost basis or to take advantage of short-term swing trading opportunities.

While we don’t know how the next months will unfold and when and how this bear market will end, all we can do is to stick to the data and stay vigilant and agile in our decisions.

And another reminder: Don’t underestimate the power of memes during a bear market… During grim times, not taking everything too seriously (except for your health and loved ones) can be a powerful weapon!

Thanks Ellio🥂

so how do we transfer from and to a hardware wallet